1.38*(44.38+51.56)-0.7*(48.21+51.56)1

\(\{ ε_t \} ∼ W N(0, σ^2_ε)\)이고, \(\{Z_t\}\)에 대하여 다음의 모형을 고려한다.

\[(1 − ϕ_1B − ϕ_2B^2)Z_t = ε_t\]

이 때, \(Z_{n+l}\)의 l−시차 후 MMSE 예측함수 \(Z_n{(l)}\)을 구하여라. 단, 예측함수는 관측값 \(Z_1, . . . , Z_n\)의 함수 형태로 구할 수 있다.

위 식은 \(AR(2)\)모형이다.

(hat생략..)

\(Z_n(1) = E(Z_{n+1}|Z_n,Z_{n-1},\dots,Z_1) = E(\phi_1 Z_n + \phi_2 Z_{n-1} + \epsilon_{n+1}|Z_n,Z_{n-1},\dots,Z_1)= \phi_1 Z_n + \phi_2 Z_{n-1}\)

\(Z_n(2) = E(Z_{n+2}|Z_n,Z_{n-1},\dots,Z_1)= E(\phi_1 Z_{n+1} + \phi_2 Z_{n} + \epsilon_{n+2}|Z_n,Z_{n-1},\dots,Z_1) = E(\phi_1 Z_{n+1}|Z_n,Z_{n-1},\dots,Z_1) + \phi_2 Z_n= \phi_1 Z_n(1) + \phi_2 Z_n\)

\(Z_n(3) = E(Z_{n+3}|Z_n,Z_{n-1},\dots,Z_1)= E(\phi_1 Z_{n+2} + \phi_2 Z_{n+1} + \epsilon_{n+3}|Z_n,Z_{n-1},\dots,Z_1) = \phi_1 Z_n(2) + \phi_2 Z_n(1)\)

이를 일반화하면, \(Z_n(l) = \phi_1 Z_n(l-1) + \phi_2 Z_n (l-2)\)이다.

2

어느 시계열자료 \({Z_1, . . . , Z_{100}}\)는 AR(2)모형에 적합되어 모수들의 추정값

\[\hat ϕ_1 = 1.38, \hat ϕ_2 = −0.7, \hat µ = 51.56, \hat σ^2_ε = 4.41\]

을 얻었다. 이 시계열의 마지막 5개 자료는

\[Z_{96} = 52.65, Z_{97} = 54.87, Z_{98} = 53.37, Z_{99} = 48.21, Z_{100} = 44.38\]

이다. 1번의 결과를 이용하여 다음 물음에 답하여라.

(1)

\(Z_{101}, Z_{102}, Z_{103}, Z_{104}, Z_{105}\) 를 예측하여라

문제의 AR(2)은 평균이 있는 모형이다.

즉, 1번의 문제와 비슷하지만 \((1 − ϕ_1B − ϕ_2B^2)(Z_t-\mu)= ε_t\) 이므로

\(Z_n(l) = \phi_1 (Z_n(l-1) +\mu) + \phi_2 (Z_n (l-2) + \mu)\)이므로..

\(Z_{101} = Z_{100}(1) = 1.38 \times (44.38+51.56) - 0.7 \times (48.21 + 51.56)\)

\(Z_{102} = Z_{100}(2) = \hat ϕ_1 (Z_{101}+\hat\mu) + \hat ϕ_2 (Z_{100} +\hat\mu)\)

1.38*(62.5582+51.56) - 0.7*(44.38 + 51.56)\(Z_{103} = Z_{100}(3) = \hat ϕ_1 (Z_{102}+\hat\mu) + \hat ϕ_2( Z_{101} +\hat\mu)\)

1.38*(90.325116+51.56) -0.7* (62.5582 + 51.56)\(Z_{104} = Z_{100}(4) = \hat ϕ_1 (Z_{103}+\hat\mu) +\hat ϕ_2 (Z_{102} + \hat \mu )\)

1.38*(115.91872008+51.56)-0.7*(90.325116 + 51.56)\(Z_{105} = Z_{100}(5) = \hat ϕ_1 (Z_{104}+\hat\mu) +\hat ϕ_2 (Z_{103} + \hat \mu)\)

1.38*(131.8010525104+51.56)-0.7*(115.91872008+51.56)(2)

최근에 시점 \(t = 101\)에서 \(Z_{101} = 47.08\)을 얻었다. \(Z_{102}, Z_{103}, Z_{104}, Z_{105}\) 의 예측값을 각각 갱신하여라.

\(Z_{102} = Z_{100}(2) = \hat ϕ_1( Z_{101} + \hat \mu) + \hat ϕ_2( Z_{100} + \hat \mu)\)

1.38*(47.08+51.56)-0.7*(44.38+51.56)\(Z_{103} = Z_{100}(3) = \hat ϕ_1 (Z_{102} + \hat \mu)+ \hat ϕ_2 (Z_{101} + \hat \mu)\)

1.38*(68.9652+51.56)-0.7*(47.08+51.56)\(Z_{104} = Z_{100}(4) = \hat ϕ_1 (Z_{103} + \hat \mu) + \hat ϕ_2 (Z_{102} + \hat \mu)\)

1.38*(97.276776+51.56)-0.7*(68.9652+51.56)\(Z_{105} = Z_{100}(5) = \hat ϕ_1 (Z_{104} + \hat \mu) + \hat ϕ_2 (Z_{103} + \hat \mu)\)

1.38*(121.02711088+51.56)-0.7*(97.276776+51.56)3

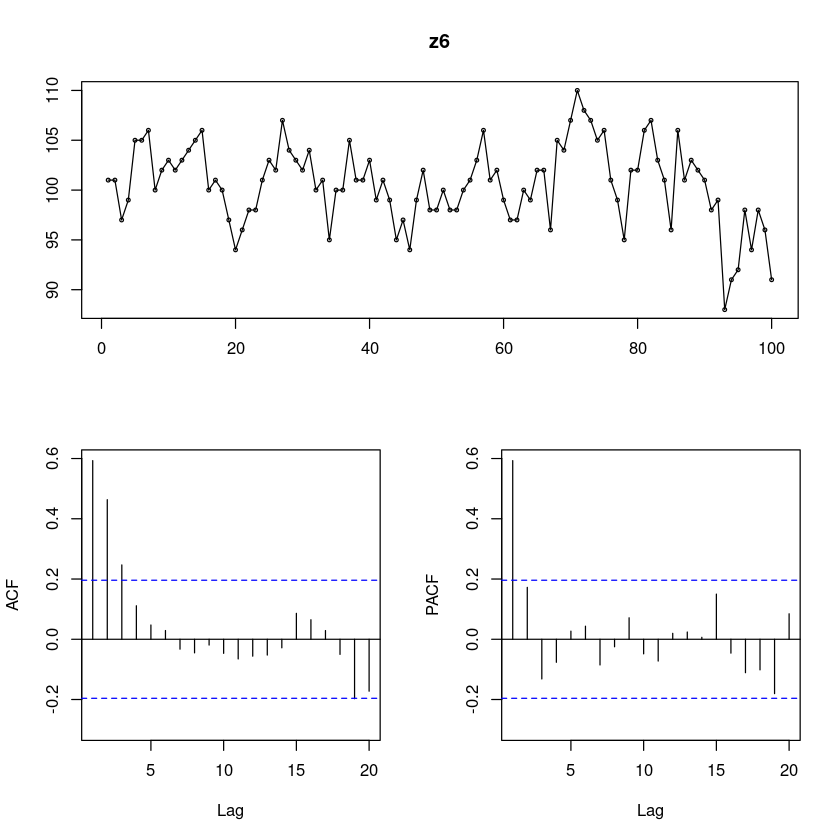

(R실습). HW04의 6번에서 적합한 모형에 대하여 마지막 시점 이후 25시점의 값을 예측하고, 예측값과 예측구간을 원시계열 자료의 시계열 그림 위에 겹쳐 그려라.

z6 <- scan("ex8_2b.txt")

forecast::tsdisplay(z6)Registered S3 method overwritten by 'quantmod':

method from

as.zoo.data.frame zoo

## 모형적합 AR(1)

fit <- arima(z6,order=c(1,0,0))

summary(fit)

Call:

arima(x = z6, order = c(1, 0, 0))

Coefficients:

ar1 intercept

0.6231 100.4528

s.e. 0.0805 0.8253

sigma^2 estimated as 9.962: log likelihood = -257.08, aic = 520.16

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -0.004602625 3.156255 2.452284 -0.1060461 2.457104 0.8991709

ACF1

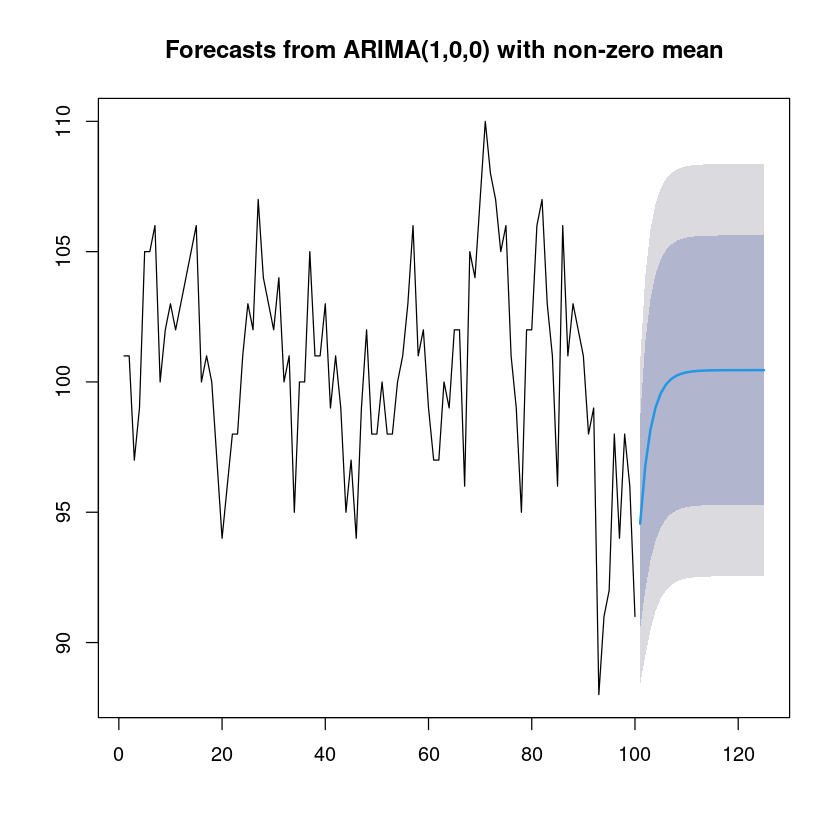

Training set -0.100928forecast_fit <- forecast::forecast(fit, 25)

forecast_fit Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

101 94.56289 90.51799 98.6078 88.37675 100.7490

102 96.78288 92.01704 101.5487 89.49415 104.0716

103 98.16612 93.14822 103.1840 90.49190 105.8403

104 99.02800 93.91559 104.1404 91.20924 106.8468

105 99.56502 94.41638 104.7137 91.69086 107.4392

106 99.89963 94.73700 105.0623 92.00407 107.7952

107 100.10812 94.94007 105.2762 92.20427 108.0120

108 100.23803 95.06787 105.4082 92.33096 108.1451

109 100.31897 95.14800 105.4899 92.41065 108.2273

110 100.36941 95.19812 105.5407 92.46060 108.2782

111 100.40083 95.22942 105.5722 92.49184 108.3098

112 100.42041 95.24895 105.5919 92.51134 108.3295

113 100.43261 95.26113 105.6041 92.52352 108.3417

114 100.44022 95.26873 105.6117 92.53111 108.3493

115 100.44495 95.27346 105.6164 92.53584 108.3541

116 100.44790 95.27641 105.6194 92.53879 108.3570

117 100.44974 95.27825 105.6212 92.54063 108.3589

118 100.45089 95.27940 105.6224 92.54177 108.3600

119 100.45160 95.28011 105.6231 92.54249 108.3607

120 100.45205 95.28055 105.6235 92.54293 108.3612

121 100.45232 95.28083 105.6238 92.54321 108.3614

122 100.45250 95.28100 105.6240 92.54338 108.3616

123 100.45260 95.28111 105.6241 92.54349 108.3617

124 100.45267 95.28118 105.6242 92.54356 108.3618

125 100.45271 95.28122 105.6242 92.54360 108.3618plot(forecast_fit)

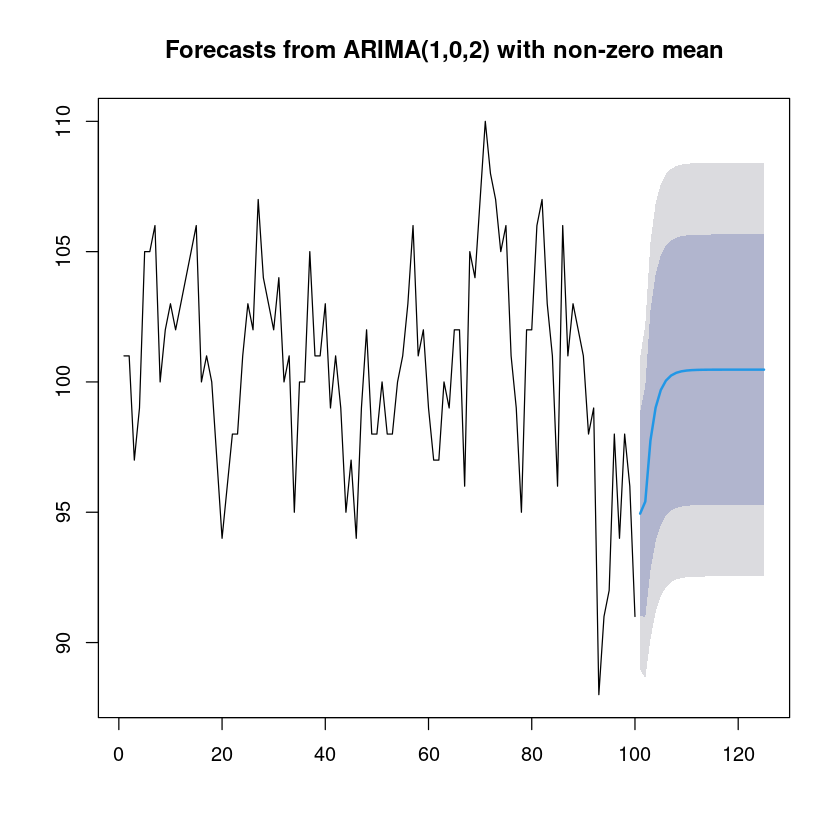

## 모형적합 ARMA(1,2)

fitt <- arima(z6,order=c(1,0,2))

summary(fitt)

forecast_fitt <- forecast::forecast(fitt, 25)

forecast_fitt

plot(forecast_fitt)

Call:

arima(x = z6, order = c(1, 0, 2))

Coefficients:

ar1 ma1 ma2 intercept

0.5368 -0.0066 0.2947 100.4720

s.e. 0.1644 0.1651 0.1335 0.8385

sigma^2 estimated as 9.348: log likelihood = -253.99, aic = 517.99

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -0.01379953 3.057498 2.356181 -0.1089919 2.361273 0.8639331

ACF1

Training set 0.007421317 Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

101 94.94724 91.02890 98.86559 88.95466 100.9398

102 95.40892 90.97386 99.84397 88.62609 102.1917

103 97.75397 92.77164 102.73630 90.13416 105.3738

104 99.01288 93.88365 104.14210 91.16841 106.8573

105 99.68870 94.51792 104.85948 91.78067 107.5967

106 100.05150 94.86881 105.23420 92.12526 107.9777

107 100.24627 95.06015 105.43239 92.31478 108.1778

108 100.35083 95.16372 105.53794 92.41783 108.2838

109 100.40696 95.21956 105.59435 92.47352 108.3404

110 100.43709 95.24961 105.62456 92.50353 108.3706

111 100.45326 95.26576 105.64076 92.51967 108.3869

112 100.46195 95.27444 105.64945 92.52834 108.3956

113 100.46661 95.27910 105.65412 92.53300 108.4002

114 100.46911 95.28160 105.65662 92.53550 108.4027

115 100.47046 95.28295 105.65797 92.53684 108.4041

116 100.47118 95.28367 105.65869 92.53757 108.4048

117 100.47156 95.28405 105.65907 92.53795 108.4052

118 100.47177 95.28426 105.65928 92.53816 108.4054

119 100.47188 95.28437 105.65939 92.53827 108.4055

120 100.47194 95.28443 105.65945 92.53833 108.4056

121 100.47198 95.28447 105.65949 92.53836 108.4056

122 100.47199 95.28448 105.65950 92.53838 108.4056

123 100.47200 95.28449 105.65951 92.53839 108.4056

124 100.47201 95.28450 105.65952 92.53840 108.4056

125 100.47201 95.28450 105.65952 92.53840 108.4056

4__다시다시

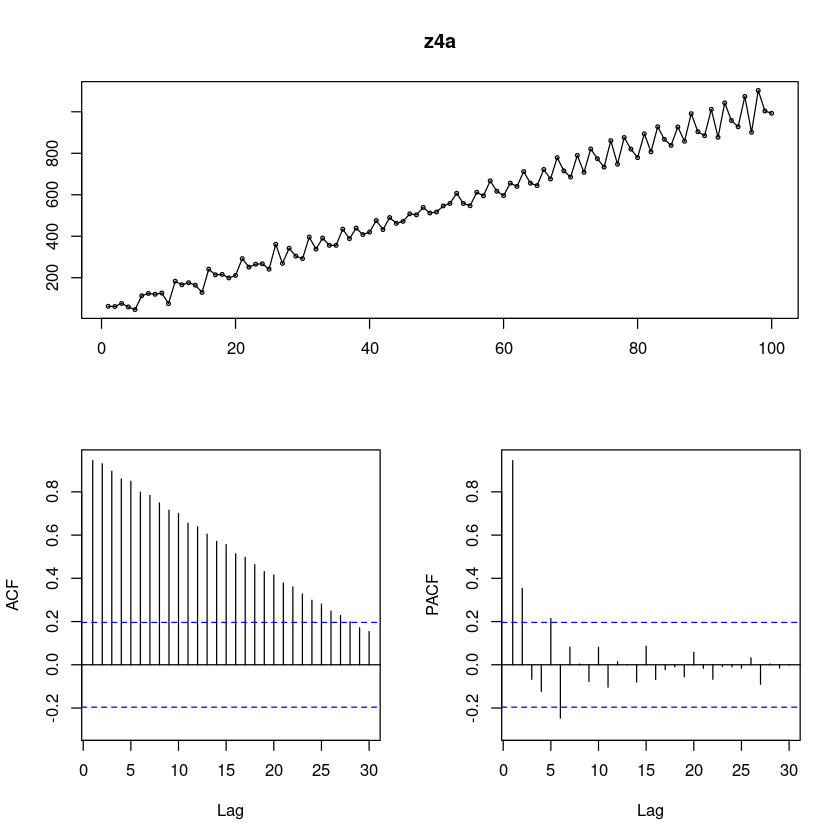

(R실습). ex10_41.txt, ex10_4b.txt 자료는 어느 확률과정으로부터 생성된 모의 실험자료이다.

- ex10_4a인듯?

(1)

각 시계열 \(\{Z_t \}\)의 시계열 그림을 그려라.

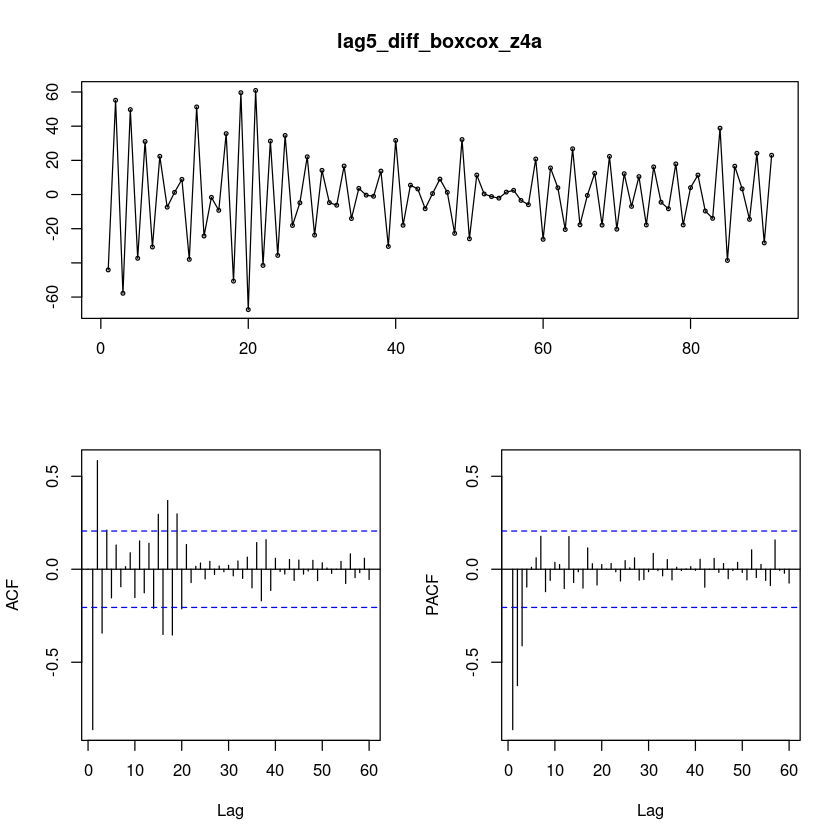

z4a <- scan("ex10_4a.txt")

forecast::tsdisplay(z4a, lag.max=30)

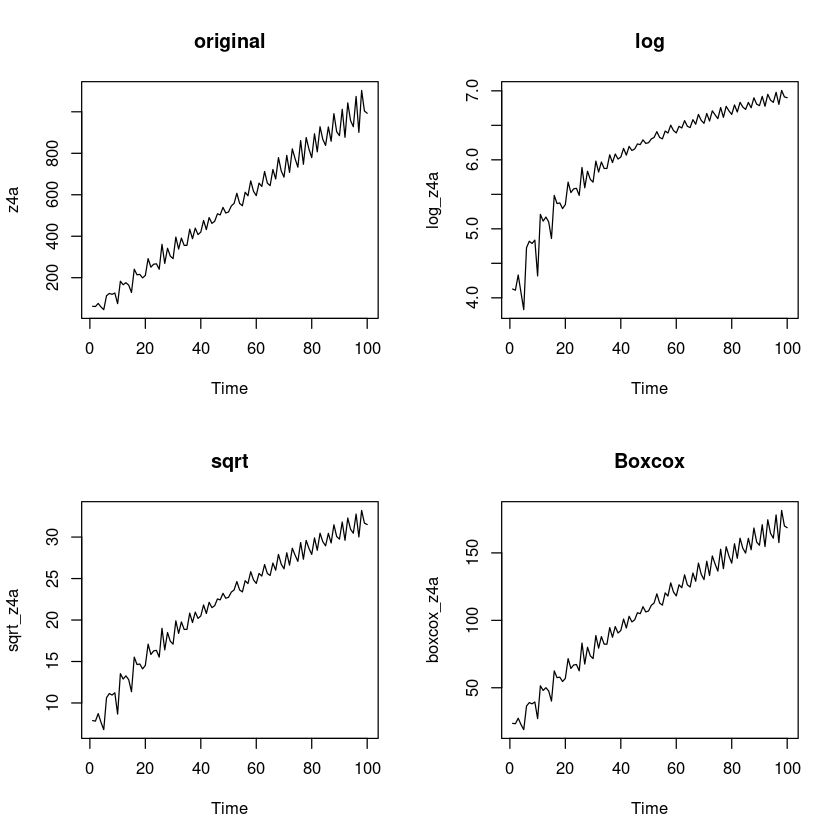

시도표를 확인해보니 추세가 있어보인다. 시간이 지날수록 분산이 조금씩 커지는 것 같다. 계절성분은.. 없어보인다.

ACF는 점점 감소하고 있다.(확률적 추세)

PACF는 2차시까지 살아있는 것 같고.. (5차시와 6차시가 조금 튀어나왔지만 무시할만하다..)

AR(2)모형인가?

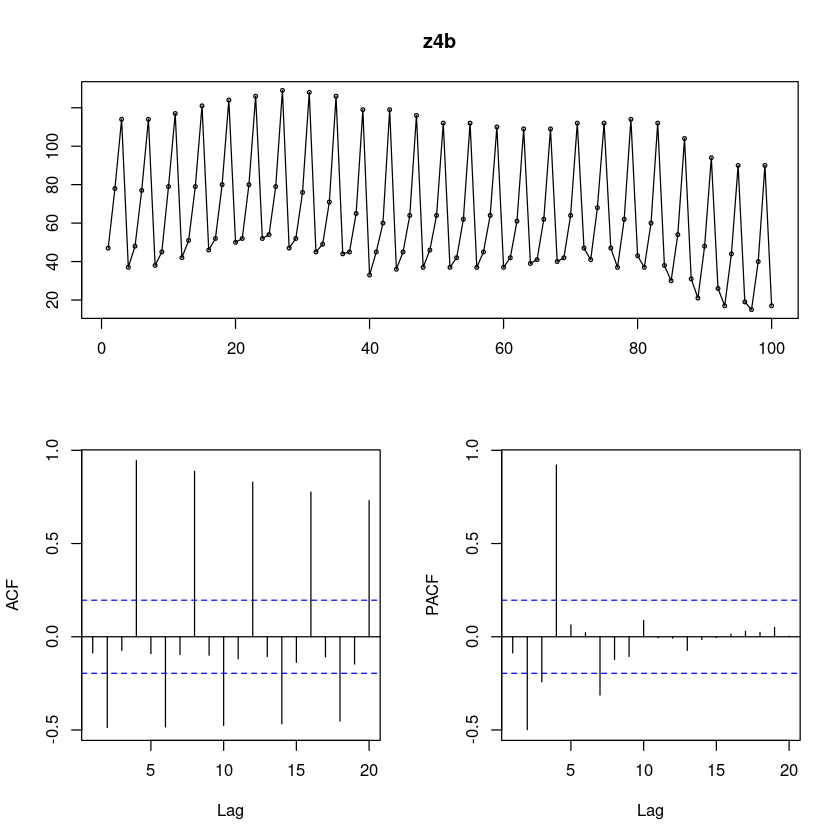

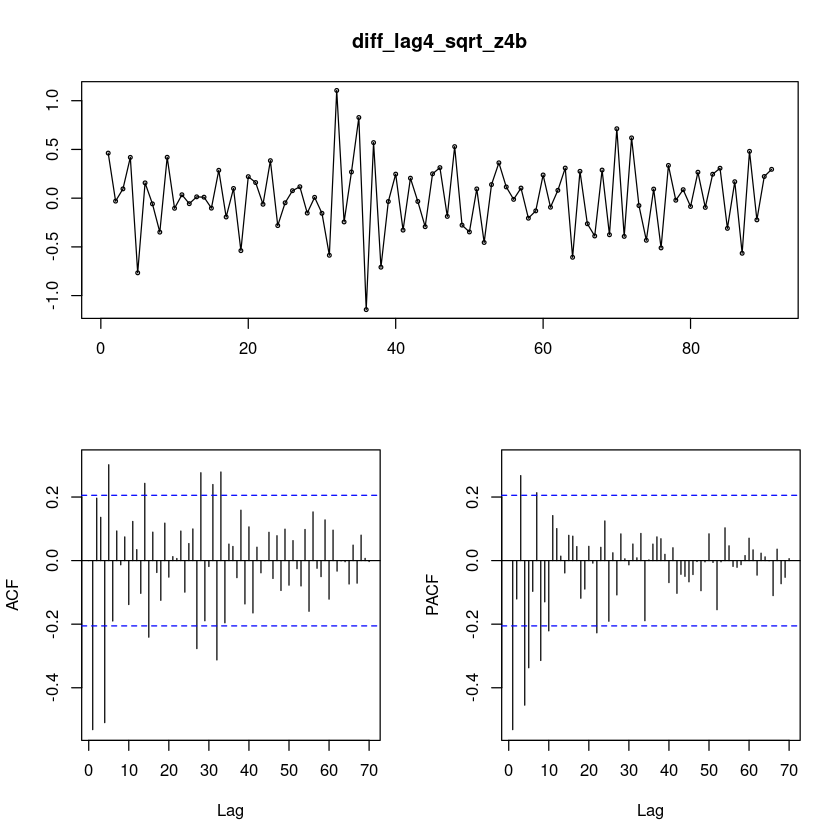

z4b <- scan("ex10_4b.txt")

forecast::tsdisplay(z4b)

계절성분이 있어보인다. 시도표 자체가 흐물흐물

ACF sin함수? 그리면서 지수적으로 감소하는 듯 하다. 길게보니까 천천히 감소하는 것 같기도…

PACF는.. 2차시…4차시.. 6차시가 살아있고

PACF가 4이후에 절단된 형태이다.

ARIMA(0,0,0)(1,0,0)_4 로 보이기도 하네

(2)

각 시계열 \(\{Z_t\}\)의 SACF와 SPACF를 그려라

(1)과 동일. 생략

(3)

각 시계열이 정상시계열이 되도록 적절한 변환 혹은 차분을 단계적으로 취하여라

z4a

log_z4a = log(z4a)

sqrt_z4a = sqrt(z4a)

boxcox_z4a = forecast::BoxCox(z4a,lambda= forecast::BoxCox.lambda(z4a))

par(mfrow=c(2,2))

plot.ts(z4a, main = "original")

plot.ts(log_z4a, main = 'log')

plot.ts(sqrt_z4a, main = 'sqrt')

plot.ts(boxcox_z4a, main = 'Boxcox')

t4a = 1:length(z4a)

lmtest::bptest(lm(z4a~t4a)) #H0 : 등분산이다

lmtest::bptest(lm(log_z4a~t4a))

lmtest::bptest(lm(sqrt_z4a~t4a))

lmtest::bptest(lm(boxcox_z4a~t4a))

studentized Breusch-Pagan test

data: lm(z4a ~ t4a)

BP = 24.415, df = 1, p-value = 7.765e-07

studentized Breusch-Pagan test

data: lm(log_z4a ~ t4a)

BP = 13.279, df = 1, p-value = 0.0002684

studentized Breusch-Pagan test

data: lm(sqrt_z4a ~ t4a)

BP = 5.5272, df = 1, p-value = 0.01872

studentized Breusch-Pagan test

data: lm(boxcox_z4a ~ t4a)

BP = 0.065359, df = 1, p-value = 0.7982- boxcox하는 것이 등분산이니까.. boxcox한걸로 하자.

##단위근 검정 : H0 : 단위근이 있다.

fUnitRoots::adfTest(z4a, lags = 0, type = "c")

fUnitRoots::adfTest(z4a, lags = 6, type = "c")

fUnitRoots::adfTest(z4a, lags = 12, type = "c")

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 0

STATISTIC:

Dickey-Fuller: -1.2765

P VALUE:

0.5828

Description:

Tue Dec 12 16:40:17 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 6

STATISTIC:

Dickey-Fuller: -0.5851

P VALUE:

0.8387

Description:

Tue Dec 12 16:40:17 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 12

STATISTIC:

Dickey-Fuller: -1.1272

P VALUE:

0.638

Description:

Tue Dec 12 16:40:17 2023 by user: - P-value의 값이 0.05보다 크므로 h0를 기각할 수 없다. 즉 차분이 필요하다.

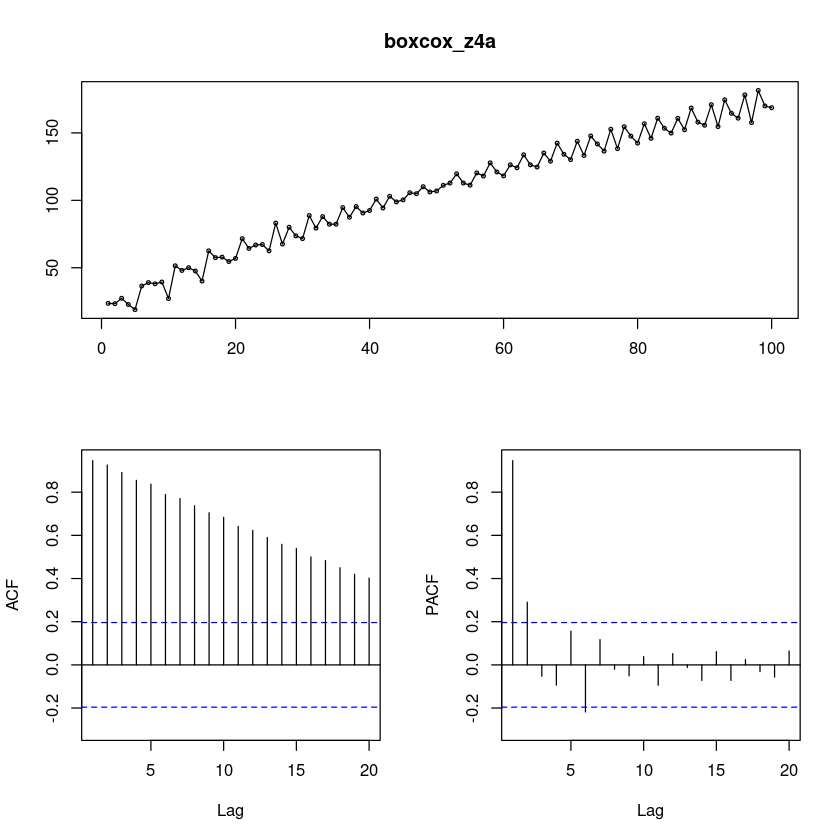

forecast::tsdisplay(boxcox_z4a)

- ACF에서 천천히 감소하는 확률적 추세를 보이니까 차분을 해보아야겠다! 계절은 솔직히 좀 애매해보인다.

diff_boxcox_z4a = diff(boxcox_z4a)

forecast::tsdisplay(diff_boxcox_z4a,lag.max=100)

차분을 했더니 계절성분이 더 잘 보인다. 지수적으로 감소하지만 중간에 튀어나온 부분이 있다.

단위근 검정을 통해서 왜 차분할 필요가 없다고 뜨지? (궁금…)

- 주기가 5로 보여서 5로 했음.

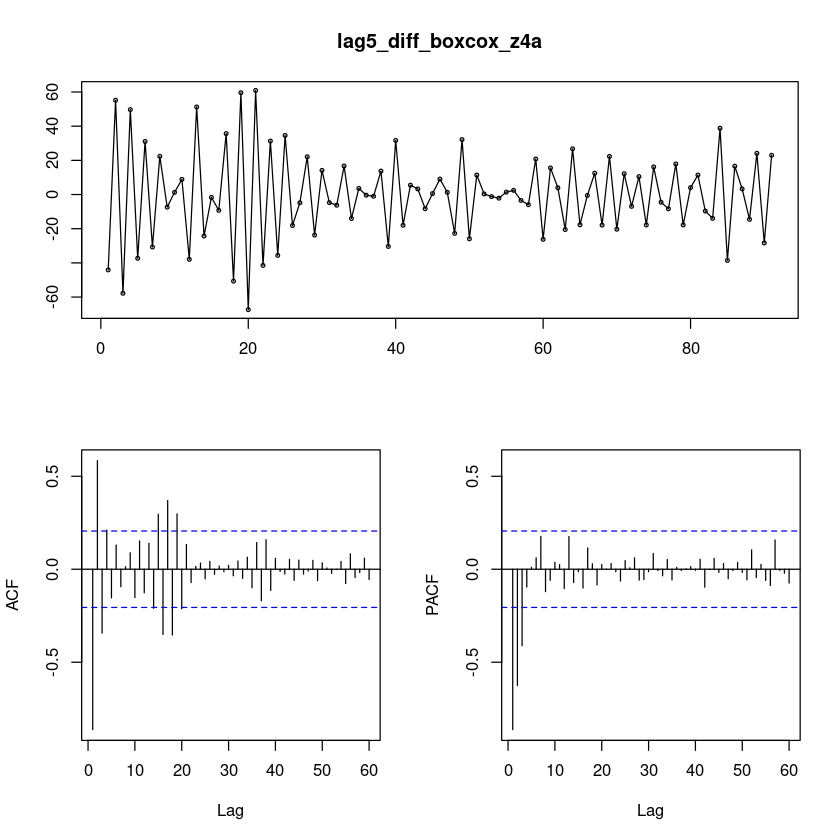

lag5_diff_boxcox_z4a = diff(diff(boxcox_z4a),5)

forecast::tsdisplay(lag5_diff_boxcox_z4a, lag.max=60)

- 상수항이 없는 AIRMA(0,0,3)(0,0,1)_5 같이 보인다..

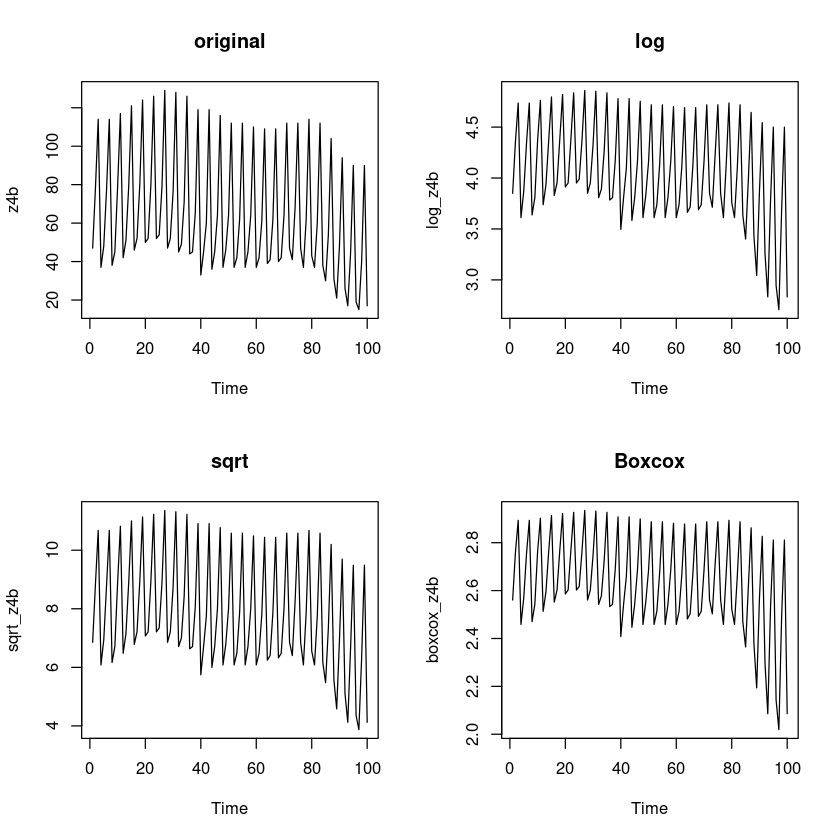

z4b

log_z4b = log(z4b)

sqrt_z4b = sqrt(z4b)

boxcox_z4b = forecast::BoxCox(z4b,lambda= forecast::BoxCox.lambda(z4b))

par(mfrow=c(2,2))

plot.ts(z4b, main = "original")

plot.ts(log_z4b, main = 'log')

plot.ts(sqrt_z4b, main = 'sqrt')

plot.ts(boxcox_z4b, main = 'Boxcox')

t4b = 1:length(z4b)

lmtest::bptest(lm(z4b~t4b)) #H0 : 등분산이다

lmtest::bptest(lm(log_z4b~t4b))

lmtest::bptest(lm(sqrt_z4b~t4b))

lmtest::bptest(lm(boxcox_z4b~t4b))

studentized Breusch-Pagan test

data: lm(z4b ~ t4b)

BP = 0.0077657, df = 1, p-value = 0.9298

studentized Breusch-Pagan test

data: lm(log_z4b ~ t4b)

BP = 8.6591, df = 1, p-value = 0.003254

studentized Breusch-Pagan test

data: lm(sqrt_z4b ~ t4b)

BP = 1.6816, df = 1, p-value = 0.1947

studentized Breusch-Pagan test

data: lm(boxcox_z4b ~ t4b)

BP = 12.23, df = 1, p-value = 0.0004702- 원데이터가 제일 P-value가 높다. 원데이터를 사용해도 좋고.. y값의 범위가 크므로 sqrt변환한 것을 사용해도 좋을 것 같다.

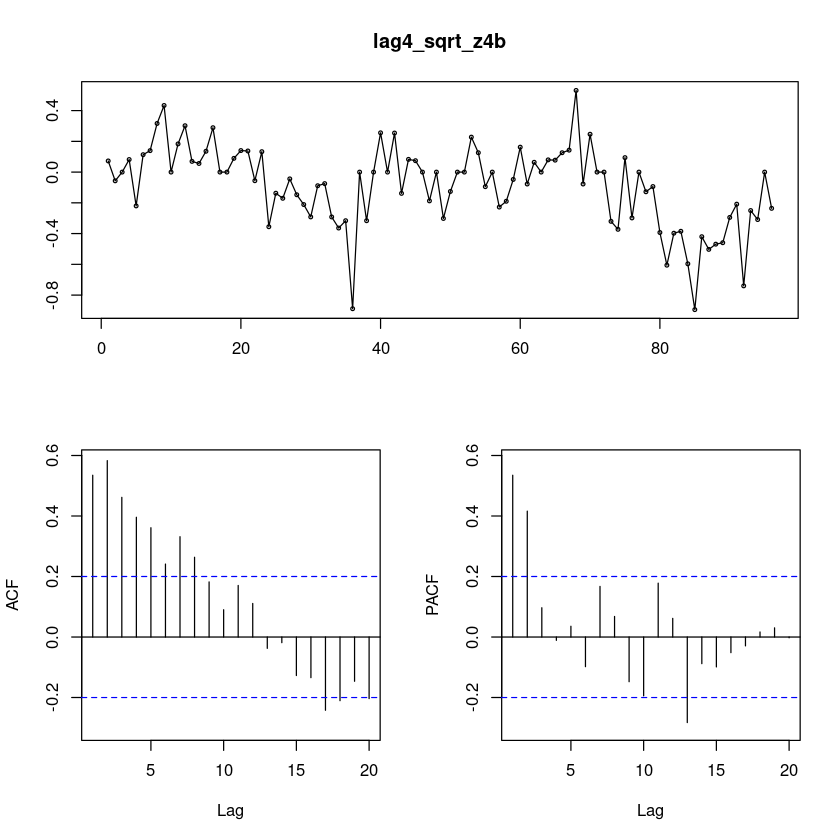

lag4_sqrt_z4b = diff(sqrt_z4b, 4)

forecast::tsdisplay(lag4_sqrt_z4b)

##단위근 검정 : H0 : 단위근이 있다.

fUnitRoots::adfTest(lag4_sqrt_z4b, lags = 1, type = "c")

fUnitRoots::adfTest(lag4_sqrt_z4b, lags = 2, type = "c")

fUnitRoots::adfTest(lag4_sqrt_z4b, lags = 3, type = "c")

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -2.9496

P VALUE:

0.04505

Description:

Wed Dec 13 09:49:20 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 2

STATISTIC:

Dickey-Fuller: -2.5309

P VALUE:

0.1189

Description:

Wed Dec 13 09:49:20 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 3

STATISTIC:

Dickey-Fuller: -2.4565

P VALUE:

0.1464

Description:

Wed Dec 13 09:49:20 2023 by user: - p-value값 애매하지만. 단위근이 있다고 판단하고 차분을 한 번 더 해보자

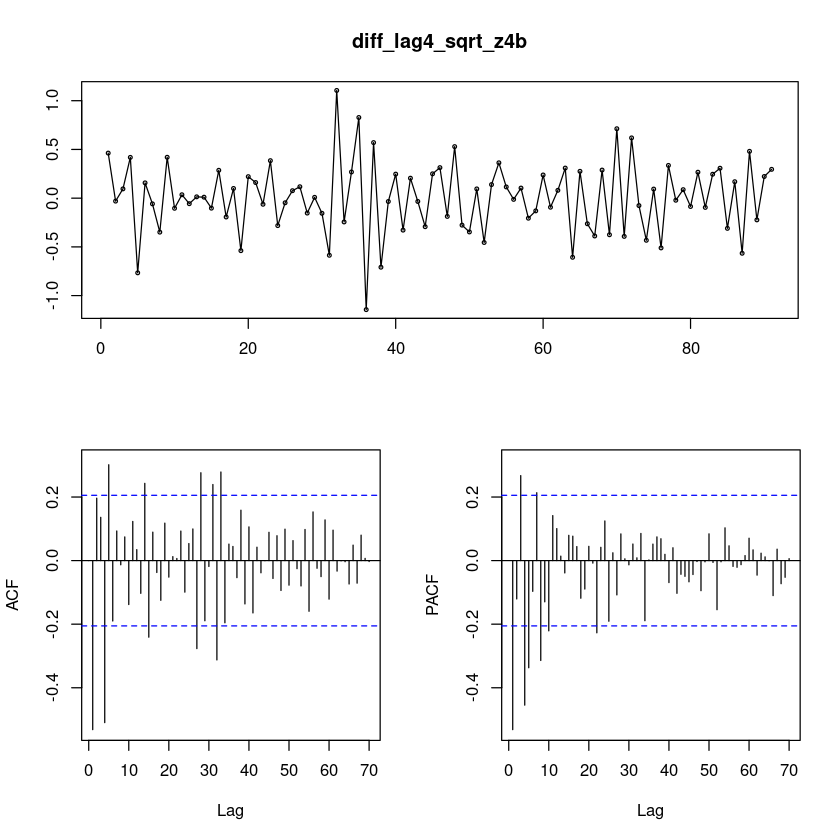

diff_lag4_sqrt_z4b = diff(diff(lag4_sqrt_z4b, 4))

forecast::tsdisplay(diff_lag4_sqrt_z4b,lag.max=70)

(4)

적절한 모형을 식별하여 적합하여라

z4a

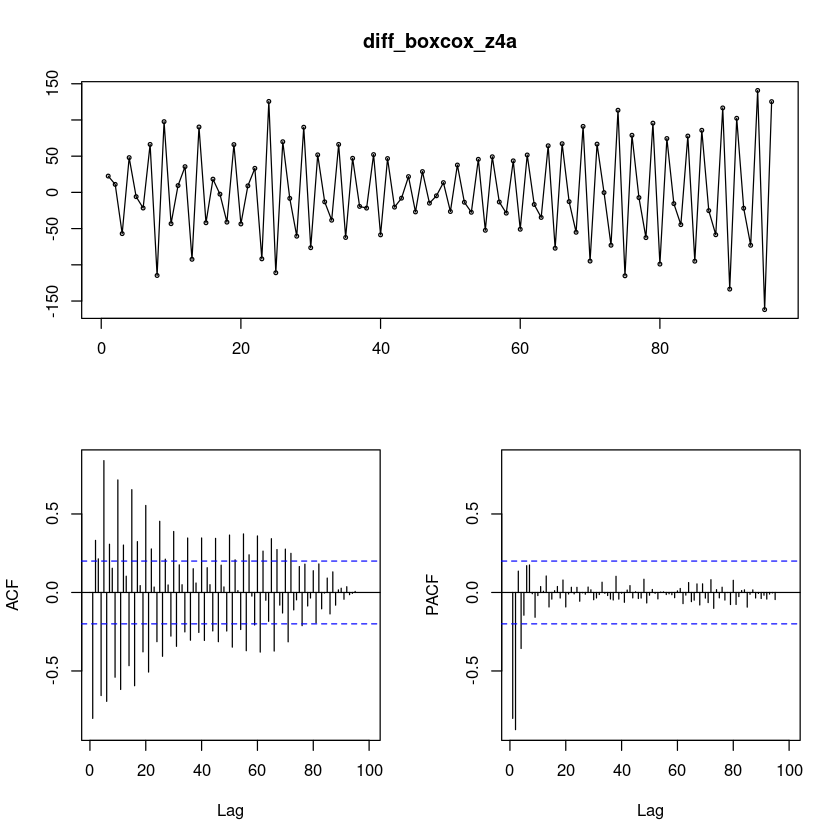

lag5_diff_boxcox_z4a = diff(diff(boxcox_z4a),5)

forecast::tsdisplay(lag5_diff_boxcox_z4a, lag.max=60)

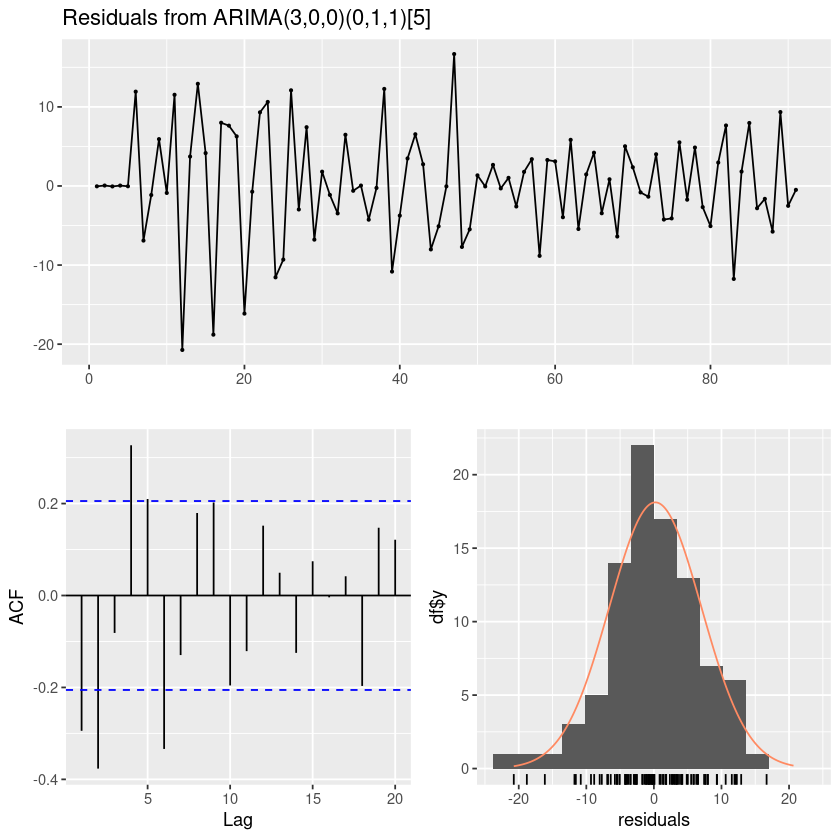

- 상수항이 없는 AIRMA(3,0,0)(0,1,1)_5 같이 보인다..

lag5_diff_boxcox_z = \(ARIMA(3,0,0)(0,1,1)_{5}\)

t.test(lag5_diff_boxcox_z4a)

One Sample t-test

data: lag5_diff_boxcox_z4a

t = -0.038719, df = 90, p-value = 0.9692

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-5.443111 5.235003

sample estimates:

mean of x

-0.1040539 - 모형1(내가 생각한)

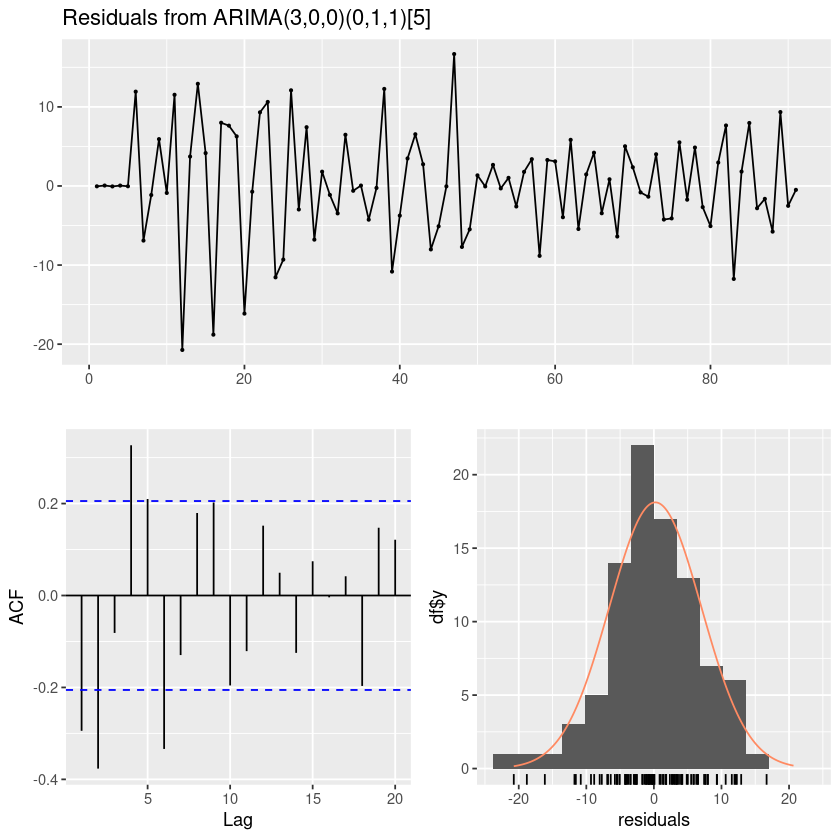

fit11 = arima(lag5_diff_boxcox_z4a, order = c(3,0,0), include.mean=F,

seasonal = list(order = c(0,1,1), period=5))

summary(fit11)

lmtest::coeftest(fit11)

Call:

arima(x = lag5_diff_boxcox_z4a, order = c(3, 0, 0), seasonal = list(order = c(0,

1, 1), period = 5), include.mean = F)

Coefficients:

ar1 ar2 ar3 sma1

-1.8850 -1.5761 -0.6237 -1.000

s.e. 0.0823 0.1347 0.0830 0.145

sigma^2 estimated as 48.66: log likelihood = -299, aic = 608

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set 0.212755 6.781579 5.107949 40.42187 92.98714 0.1347569 -0.2943703

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 -1.885039 0.082273 -22.9119 < 2.2e-16 ***

ar2 -1.576098 0.134729 -11.6983 < 2.2e-16 ***

ar3 -0.623737 0.083004 -7.5145 5.712e-14 ***

sma1 -0.999999 0.145009 -6.8961 5.344e-12 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1음.. 근데 또 생각해보니 주기가 5인디.. ma1,ma2,ma3,sma1이 의미가 있남??

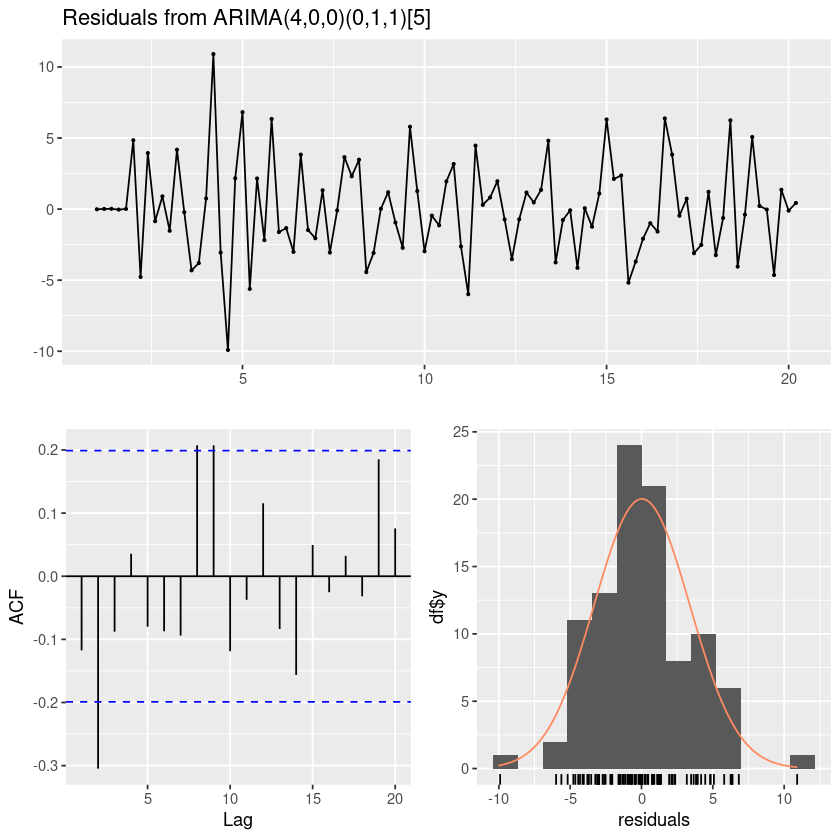

- 모형2(AUTO)

fit12 <- forecast::auto.arima(ts(boxcox_z4a, frequency=5),

test = "adf",

seasonal = TRUE, trace = T)

ARIMA(2,0,2)(1,1,1)[5] with drift : Inf

ARIMA(0,0,0)(0,1,0)[5] with drift : 740.7953

ARIMA(1,0,0)(1,1,0)[5] with drift : 626.1767

ARIMA(0,0,1)(0,1,1)[5] with drift : Inf

ARIMA(0,0,0)(0,1,0)[5] : 738.7131

ARIMA(1,0,0)(0,1,0)[5] with drift : 624.2993

ARIMA(1,0,0)(0,1,1)[5] with drift : 625.7293

ARIMA(1,0,0)(1,1,1)[5] with drift : Inf

ARIMA(2,0,0)(0,1,0)[5] with drift : 584.0149

ARIMA(2,0,0)(1,1,0)[5] with drift : 585.8908

ARIMA(2,0,0)(0,1,1)[5] with drift : 585.3023

ARIMA(2,0,0)(1,1,1)[5] with drift : 584.8715

ARIMA(3,0,0)(0,1,0)[5] with drift : 551.7999

ARIMA(3,0,0)(1,1,0)[5] with drift : 549.1616

ARIMA(3,0,0)(2,1,0)[5] with drift : 544.3506

ARIMA(3,0,0)(2,1,1)[5] with drift : Inf

ARIMA(3,0,0)(1,1,1)[5] with drift : Inf

ARIMA(2,0,0)(2,1,0)[5] with drift : 578.1867

ARIMA(4,0,0)(2,1,0)[5] with drift : 520.1342

ARIMA(4,0,0)(1,1,0)[5] with drift : 528.2307

ARIMA(4,0,0)(2,1,1)[5] with drift : 513.4132

ARIMA(4,0,0)(1,1,1)[5] with drift : Inf

ARIMA(4,0,0)(2,1,2)[5] with drift : Inf

ARIMA(4,0,0)(1,1,2)[5] with drift : 513.3994

ARIMA(4,0,0)(0,1,2)[5] with drift : Inf

ARIMA(4,0,0)(0,1,1)[5] with drift : 510.9336

ARIMA(4,0,0)(0,1,0)[5] with drift : 532.0723

ARIMA(3,0,0)(0,1,1)[5] with drift : Inf

ARIMA(4,0,1)(0,1,1)[5] with drift : Inf

ARIMA(3,0,1)(0,1,1)[5] with drift : Inf

ARIMA(4,0,0)(0,1,1)[5] : 508.5887

ARIMA(4,0,0)(0,1,0)[5] : 529.7897

ARIMA(4,0,0)(1,1,1)[5] : Inf

ARIMA(4,0,0)(0,1,2)[5] : Inf

ARIMA(4,0,0)(1,1,0)[5] : 525.8971

ARIMA(4,0,0)(1,1,2)[5] : 510.9393

ARIMA(3,0,0)(0,1,1)[5] : Inf

ARIMA(4,0,1)(0,1,1)[5] : Inf

ARIMA(3,0,1)(0,1,1)[5] : Inf

Best model: ARIMA(4,0,0)(0,1,1)[5]

summary(fit12)

lmtest::coeftest(fit12) Series: ts(boxcox_z4a, frequency = 5)

ARIMA(4,0,0)(0,1,1)[5]

Coefficients:

ar1 ar2 ar3 ar4 sma1

-2.1667 -2.3899 -1.6894 -0.5040 0.8504

s.e. 0.0887 0.1687 0.1721 0.0903 0.1266

sigma^2 = 12.41: log likelihood = -247.8

AIC=507.6 AICc=508.59 BIC=522.73

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.02965456 3.336453 2.523371 240.7739 267.0698 0.2449732

ACF1

Training set -0.1173739

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 -2.166679 0.088716 -24.4226 < 2.2e-16 ***

ar2 -2.389871 0.168724 -14.1644 < 2.2e-16 ***

ar3 -1.689432 0.172074 -9.8180 < 2.2e-16 ***

ar4 -0.503953 0.090284 -5.5819 2.380e-08 ***

sma1 0.850377 0.126584 6.7179 1.844e-11 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1- auto로 적합한 모형의 AIC도 낮고.. 각 계수들도 유의해서 괜찮은 것 같다. 그런데 모형 자체가 너무 복잡한듯!

잔차분석

forecast::checkresiduals(fit11)

Ljung-Box test

data: Residuals from ARIMA(3,0,0)(0,1,1)[5]

Q* = 61.287, df = 6, p-value = 2.464e-11

Model df: 4. Total lags used: 10

forecast::checkresiduals(fit12)

Ljung-Box test

data: Residuals from ARIMA(4,0,0)(0,1,1)[5]

Q* = 24.986, df = 5, p-value = 0.0001402

Model df: 5. Total lags used: 10

t.test(resid(fit11))

One Sample t-test

data: resid(fit11)

t = 0.29777, df = 90, p-value = 0.7666

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-1.206703 1.632213

sample estimates:

mean of x

0.212755 t.test(resid(fit12))

One Sample t-test

data: resid(fit12)

t = 0.087088, df = 96, p-value = 0.9308

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.6462561 0.7055652

sample estimates:

mean of x

0.02965456 - 잔차의 평균은 0이다.

#모형 적합도 검정 : H0 : rho1=...=rho_k=0

Box.test(resid(fit11), lag=1, type = "Ljung-Box")

Box.test(resid(fit11), lag=2, type = "Ljung-Box")

Box.test(resid(fit11), lag=5, type = "Ljung-Box")

Box-Ljung test

data: resid(fit11)

X-squared = 8.1484, df = 1, p-value = 0.00431

Box-Ljung test

data: resid(fit11)

X-squared = 21.629, df = 2, p-value = 2.01e-05

Box-Ljung test

data: resid(fit11)

X-squared = 36.991, df = 5, p-value = 6.015e-07- WN이 아니당..

#모형 적합도 검정 : H0 : rho1=...=rho_k=0

Box.test(resid(fit12), lag=1, type = "Ljung-Box")

Box.test(resid(fit12), lag=6, type = "Ljung-Box")

Box.test(resid(fit12), lag=12, type = "Ljung-Box")

Box-Ljung test

data: resid(fit12)

X-squared = 1.3781, df = 1, p-value = 0.2404

Box-Ljung test

data: resid(fit12)

X-squared = 13.15, df = 6, p-value = 0.04071

Box-Ljung test

data: resid(fit12)

X-squared = 26.651, df = 12, p-value = 0.008672- WN이다. fit12를 선택하는 것이 적절해 보인다.

z4b

forecast::tsdisplay(diff_lag4_sqrt_z4b,lag.max=70)

SMA(1)?

ARIMA(0,1,1)(0,1,1)_5

- 모형1(내가 생각한)

fit11 = arima(diff_lag4_sqrt_z4b, order = c(0,1,1), include.mean=F,

seasonal = list(order = c(0,1,1), period=4))

summary(fit11)

lmtest::coeftest(fit11)

Call:

arima(x = diff_lag4_sqrt_z4b, order = c(0, 1, 1), seasonal = list(order = c(0,

1, 1), period = 4), include.mean = F)

Coefficients:

ma1 sma1

-1.0000 -1.0000

s.e. 0.0469 0.0655

sigma^2 estimated as 0.1375: log likelihood = -47.09, aic = 100.19

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.04078458 0.3604663 0.2723856 112.9697 122.2518 0.5489001

ACF1

Training set -0.4989492

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ma1 -1.000000 0.046855 -21.343 < 2.2e-16 ***

sma1 -0.999999 0.065499 -15.267 < 2.2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1- 모형2(AUTO)

fit123 <- forecast::auto.arima(ts(sqrt_z4b, frequency=4),

test = "adf",

seasonal = TRUE, trace = T)

summary(fit123)

lmtest::coeftest(fit123)

ARIMA(2,0,2)(1,1,1)[4] with drift : -20.17843

ARIMA(0,0,0)(0,1,0)[4] with drift : 17.47937

ARIMA(1,0,0)(1,1,0)[4] with drift : -11.73833

ARIMA(0,0,1)(0,1,1)[4] with drift : -1.067821

ARIMA(0,0,0)(0,1,0)[4] : 26.30471

ARIMA(2,0,2)(0,1,1)[4] with drift : -22.41085

ARIMA(2,0,2)(0,1,0)[4] with drift : -24.73603

ARIMA(2,0,2)(1,1,0)[4] with drift : -22.41257

ARIMA(1,0,2)(0,1,0)[4] with drift : -26.75223

ARIMA(1,0,2)(1,1,0)[4] with drift : -24.48929

ARIMA(1,0,2)(0,1,1)[4] with drift : -24.48391

ARIMA(1,0,2)(1,1,1)[4] with drift : -24.93594

ARIMA(0,0,2)(0,1,0)[4] with drift : -12.89084

ARIMA(1,0,1)(0,1,0)[4] with drift : -26.06203

ARIMA(1,0,3)(0,1,0)[4] with drift : -24.76333

ARIMA(0,0,1)(0,1,0)[4] with drift : 2.74682

ARIMA(0,0,3)(0,1,0)[4] with drift : -20.00937

ARIMA(2,0,1)(0,1,0)[4] with drift : -26.99294

ARIMA(2,0,1)(1,1,0)[4] with drift : -24.73092

ARIMA(2,0,1)(0,1,1)[4] with drift : -24.72671

ARIMA(2,0,1)(1,1,1)[4] with drift : -22.56032

ARIMA(2,0,0)(0,1,0)[4] with drift : -28.39065

ARIMA(2,0,0)(1,1,0)[4] with drift : -26.19614

ARIMA(2,0,0)(0,1,1)[4] with drift : -26.18687

ARIMA(2,0,0)(1,1,1)[4] with drift : -23.96165

ARIMA(1,0,0)(0,1,0)[4] with drift : -12.66527

ARIMA(3,0,0)(0,1,0)[4] with drift : -27.03259

ARIMA(3,0,1)(0,1,0)[4] with drift : -25.61228

ARIMA(2,0,0)(0,1,0)[4] : -29.19281

ARIMA(2,0,0)(1,1,0)[4] : -27.0484

ARIMA(2,0,0)(0,1,1)[4] : -27.03837

ARIMA(2,0,0)(1,1,1)[4] : -24.86536

ARIMA(1,0,0)(0,1,0)[4] : -11.61871

ARIMA(3,0,0)(0,1,0)[4] : -28.0884

ARIMA(2,0,1)(0,1,0)[4] : -28.08562

ARIMA(1,0,1)(0,1,0)[4] : -27.25033

ARIMA(3,0,1)(0,1,0)[4] : -25.8663

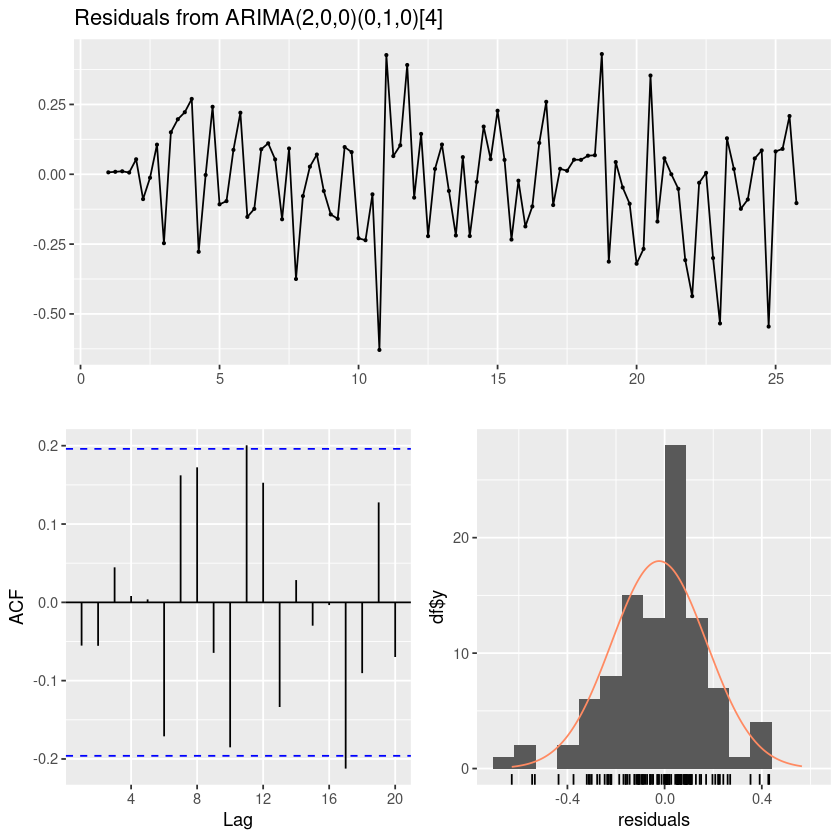

Best model: ARIMA(2,0,0)(0,1,0)[4]

Series: ts(sqrt_z4b, frequency = 4)

ARIMA(2,0,0)(0,1,0)[4]

Coefficients:

ar1 ar2

0.3275 0.4291

s.e. 0.0913 0.0912

sigma^2 = 0.04099: log likelihood = 17.73

AIC=-29.45 AICc=-29.19 BIC=-21.76

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -0.0227614 0.1962891 0.1472304 -0.4922113 2.155832 0.7396851

ACF1

Training set -0.05524958

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 0.327459 0.091311 3.5862 0.0003355 ***

ar2 0.429138 0.091227 4.7041 2.55e-06 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1잔차분석

forecast::checkresiduals(fit11)

Ljung-Box test

data: Residuals from ARIMA(3,0,0)(0,1,1)[5]

Q* = 61.287, df = 6, p-value = 2.464e-11

Model df: 4. Total lags used: 10

forecast::checkresiduals(fit123)

Ljung-Box test

data: Residuals from ARIMA(2,0,0)(0,1,0)[4]

Q* = 10.212, df = 6, p-value = 0.116

Model df: 2. Total lags used: 8

#모형 적합도 검정 : H0 : rho1=...=rho_k=0

Box.test(resid(fit11), lag=1, type = "Ljung-Box")

Box.test(resid(fit11), lag=2, type = "Ljung-Box")

Box.test(resid(fit11), lag=5, type = "Ljung-Box")

Box-Ljung test

data: resid(fit11)

X-squared = 8.1484, df = 1, p-value = 0.00431

Box-Ljung test

data: resid(fit11)

X-squared = 21.629, df = 2, p-value = 2.01e-05

Box-Ljung test

data: resid(fit11)

X-squared = 36.991, df = 5, p-value = 6.015e-07#모형 적합도 검정 : H0 : rho1=...=rho_k=0

Box.test(resid(fit123), lag=1, type = "Ljung-Box")

Box.test(resid(fit123), lag=2, type = "Ljung-Box")

Box.test(resid(fit123), lag=5, type = "Ljung-Box")

Box-Ljung test

data: resid(fit123)

X-squared = 0.3145, df = 1, p-value = 0.5749

Box-Ljung test

data: resid(fit123)

X-squared = 0.63453, df = 2, p-value = 0.7281

Box-Ljung test

data: resid(fit123)

X-squared = 0.85341, df = 5, p-value = 0.9735- ㅜㅜ auto가 더 낫다.. 계절형 ARIMA모델은 너무 어려워

(5)

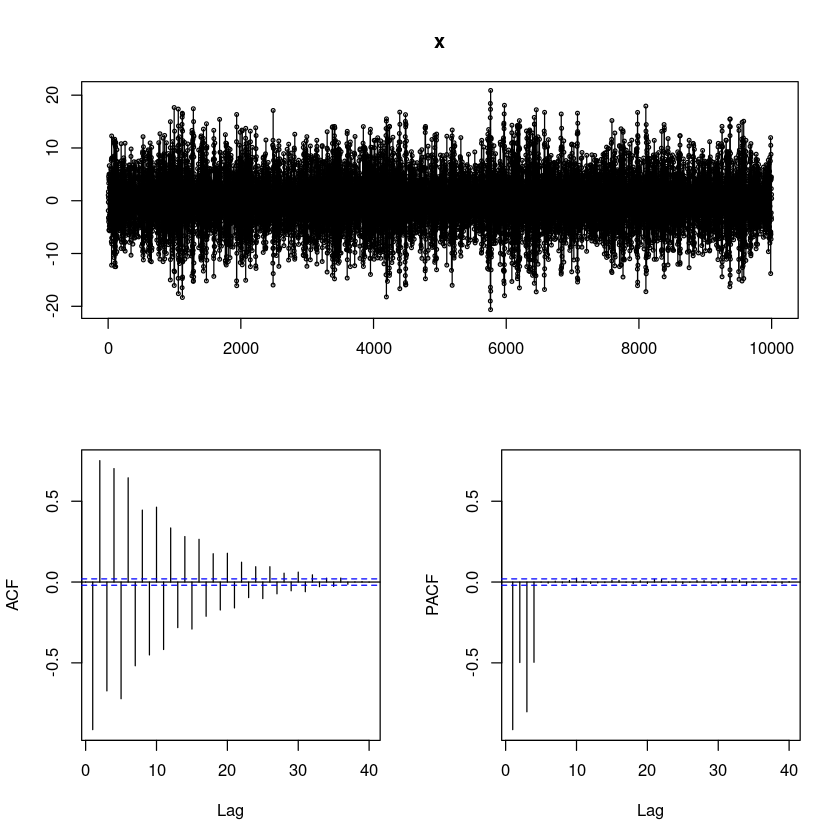

위에서 적합한 결과를 이용하여, n = 10000으로 하여 새로운 모의실험 자료를 생성하여 (2)번에서의 SACF와 SPACF를 비교하여라

### ARIMA(p,d,q)(P,D,Q)_s (z4a)

ars <- c(-2.166679, -2.389871, -1.689432, -0.503953)

sma <- 0.850377

x <- sarima::sim_sarima(n=10000, model=list(ar = ars, sma=sma), nseasons=5)

forecast::tsdisplay(x)

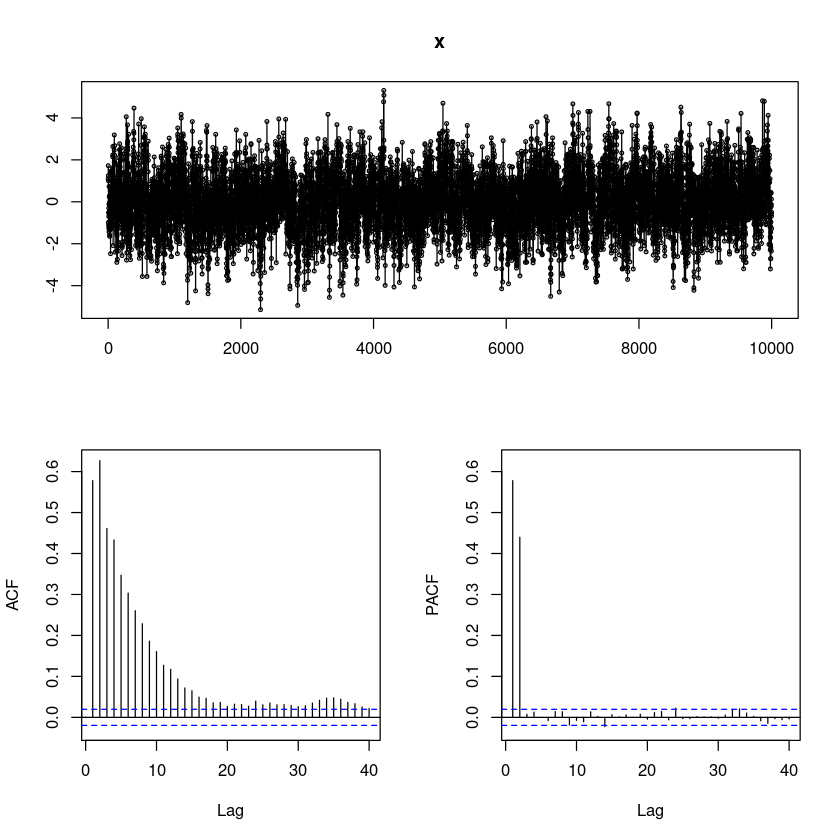

### ARIMA(p,d,q)(P,D,Q)_s (z4b)

ars <- c(0.3275, 0.4291)

x <- sarima::sim_sarima(n=10000, model=list(ar = ars), nseasons=4)

forecast::tsdisplay(x)

5

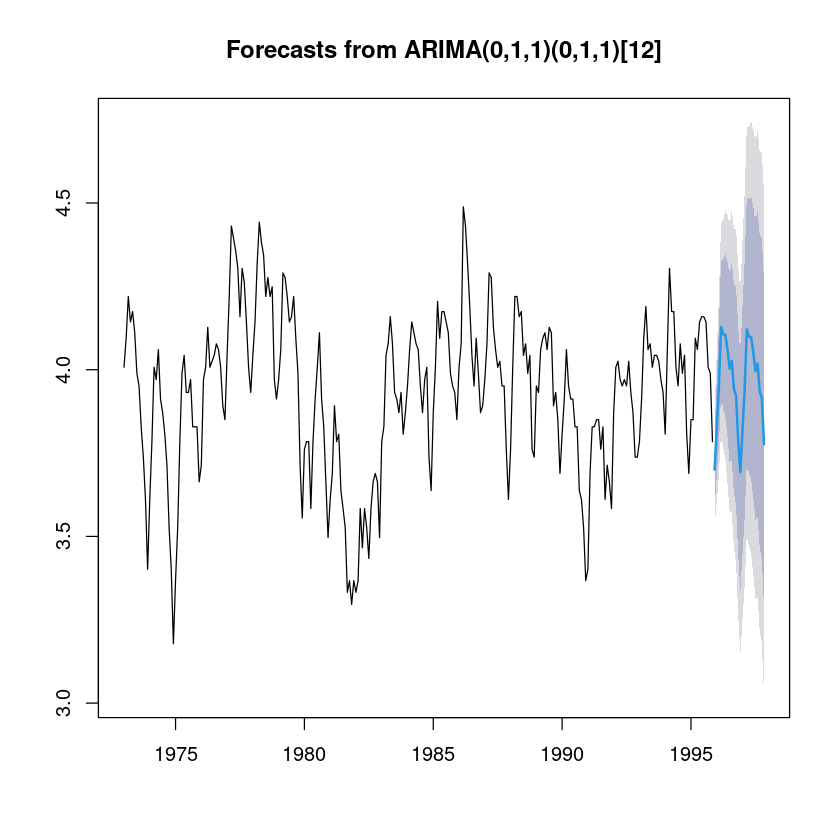

(R실습). 1973년 이후 미국에서 단독 주택의 월별 거래량 데이터(fma::hsales)에 대하여 다음 물음에 답하여라.

install.packages("fma")Installing package into ‘/home/coco/R/x86_64-pc-linux-gnu-library/4.2’

(as ‘lib’ is unspecified)

library(fma)Loading required package: forecast

str(hsales) Time-Series [1:275] from 1973 to 1996: 55 60 68 63 65 61 54 52 46 42 ...(1)

시계열 그림을 그리시오

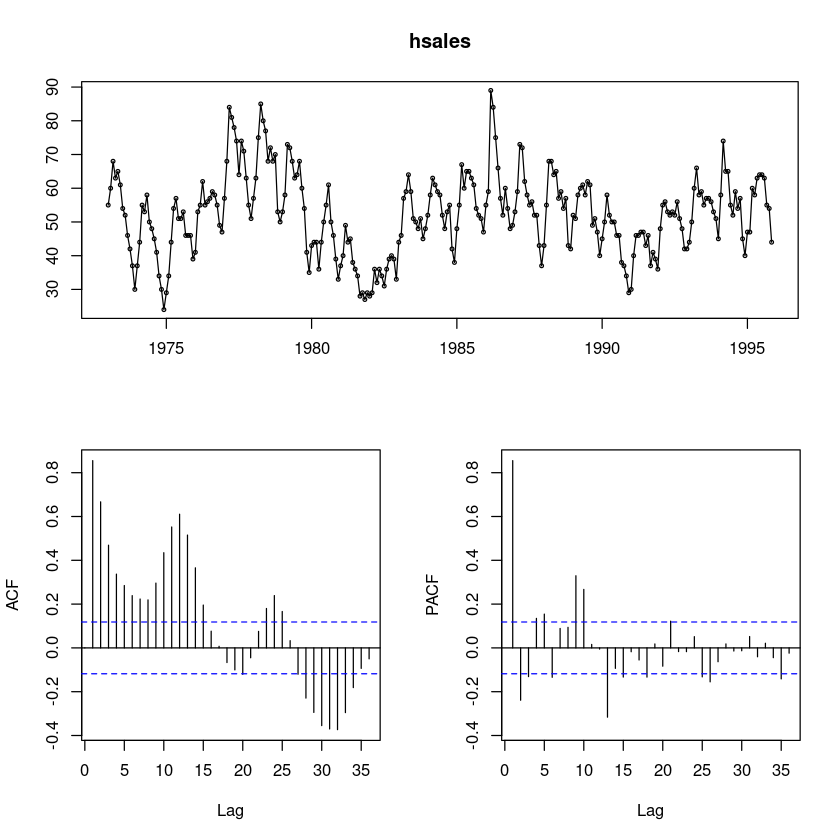

forecast::tsdisplay(hsales)

ACF가 감소하다가 중간에 튀어나오는 부분이 있어 계절성분이 있어 보인다.

PACF는 1차 이후 중간중간 유의한 부분이 보인다. 계절차분이 필요하다.

(2)

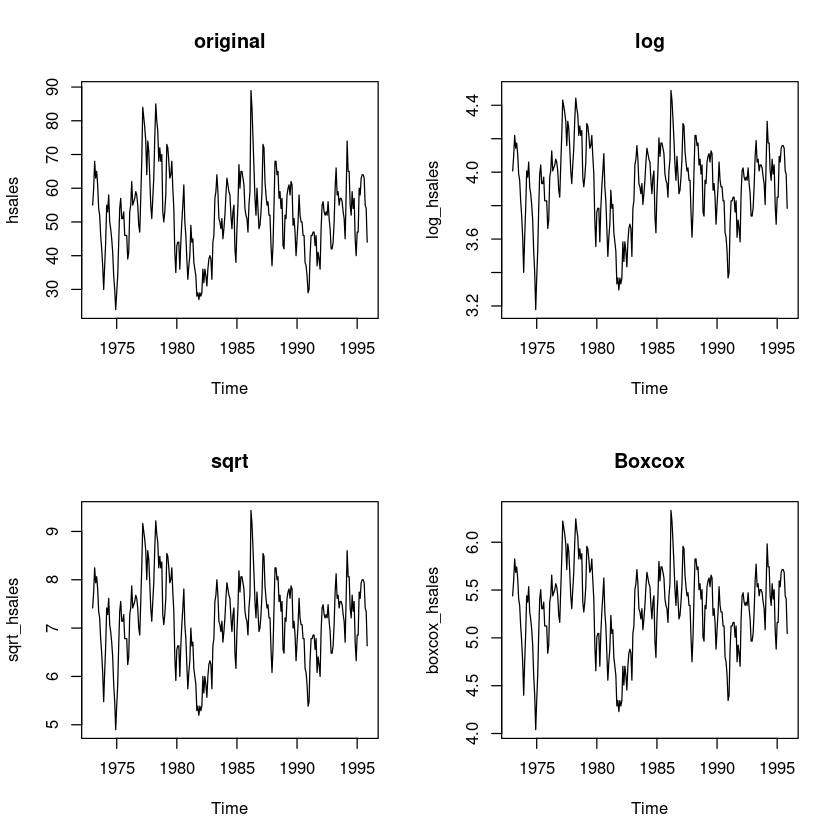

변수변환이 필요한지를 설명하고, 필요하다면 적절한 변수 변환을 하여라.

log_hsales = log(hsales)

sqrt_hsales = sqrt(hsales)

boxcox_hsales = forecast::BoxCox(hsales,lambda= forecast::BoxCox.lambda(hsales))forecast::BoxCox.lambda(hsales)par(mfrow=c(2,2))

plot.ts(hsales, main = "original")

plot.ts(log_hsales, main = 'log')

plot.ts(sqrt_hsales, main = 'sqrt')

plot.ts(boxcox_hsales, main = 'Boxcox')

th = 1:length(hsales)

lmtest::bptest(lm(hsales~th)) #H0 : 등분산이다

lmtest::bptest(lm(log_hsales~th))

lmtest::bptest(lm(sqrt_hsales~th))

lmtest::bptest(lm(boxcox_hsales~th))

studentized Breusch-Pagan test

data: lm(hsales ~ th)

BP = 11.849, df = 1, p-value = 0.0005769

studentized Breusch-Pagan test

data: lm(log_hsales ~ th)

BP = 12.557, df = 1, p-value = 0.0003947

studentized Breusch-Pagan test

data: lm(sqrt_hsales ~ th)

BP = 12.834, df = 1, p-value = 0.0003403

studentized Breusch-Pagan test

data: lm(boxcox_hsales ~ th)

BP = 12.759, df = 1, p-value = 0.0003543원데이터와 변환한데이터들간에 등분산은 큰 차이가 있어 보이진 않는다.

원데이터의 값의 범위가 크므로 log변환한 데이터를 사용한다.

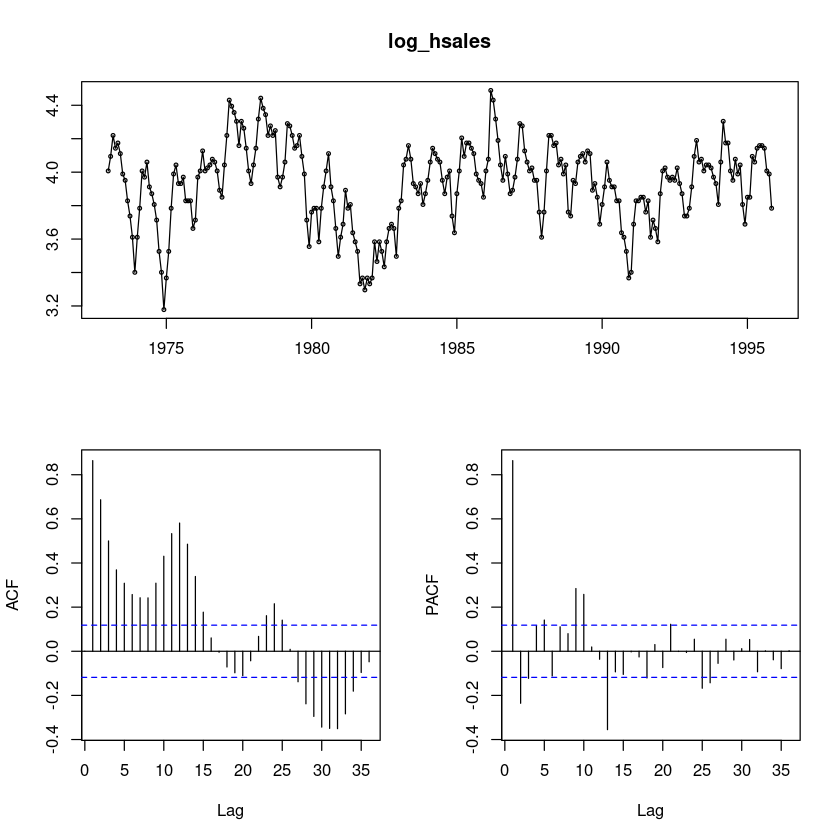

forecast::tsdisplay(log_hsales)

SAR(2), AR(2)가 보이기도 하고..

SMA(2)가 보이기도 한당

평균은 4 근처이다.

ACF가 감소하고 있고 중간에 튀어나오는 부분들이 있어서 계절차분진행

PACF가 유의한 부분이 몇개 보인다.

(3)

데이터가 정상시계열인가? 아니면 적절한 차분을 통해 정상시계열로 변환하여라

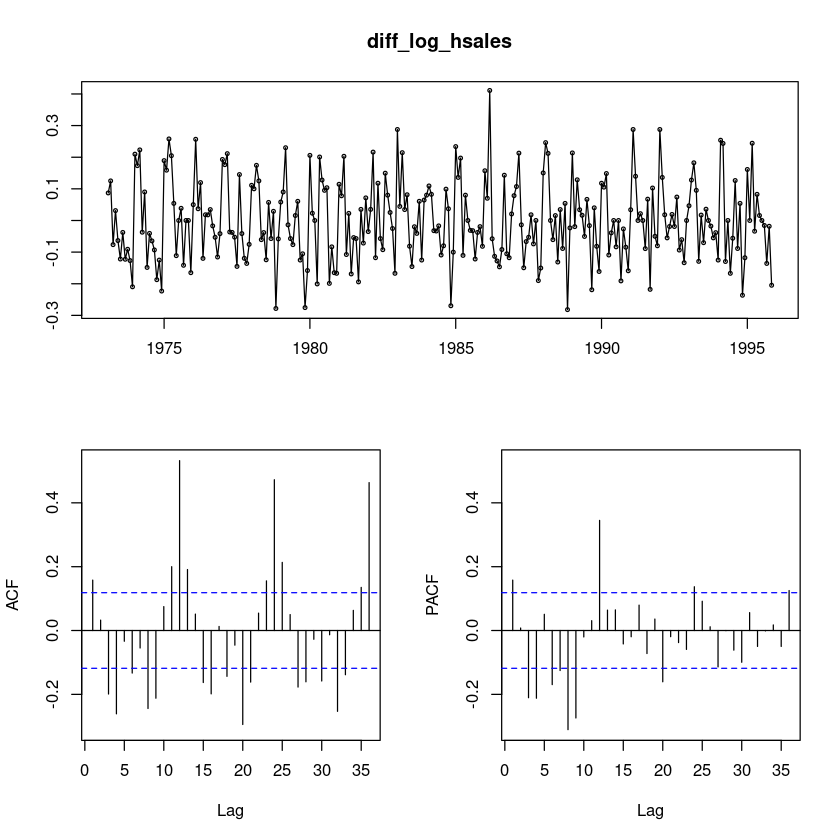

- 비정상시계열이다. 차분 진행

1

diff_log_hsales = diff(log_hsales)

forecast::tsdisplay(diff_log_hsales)

- 계절차분이 필요해 보인다.

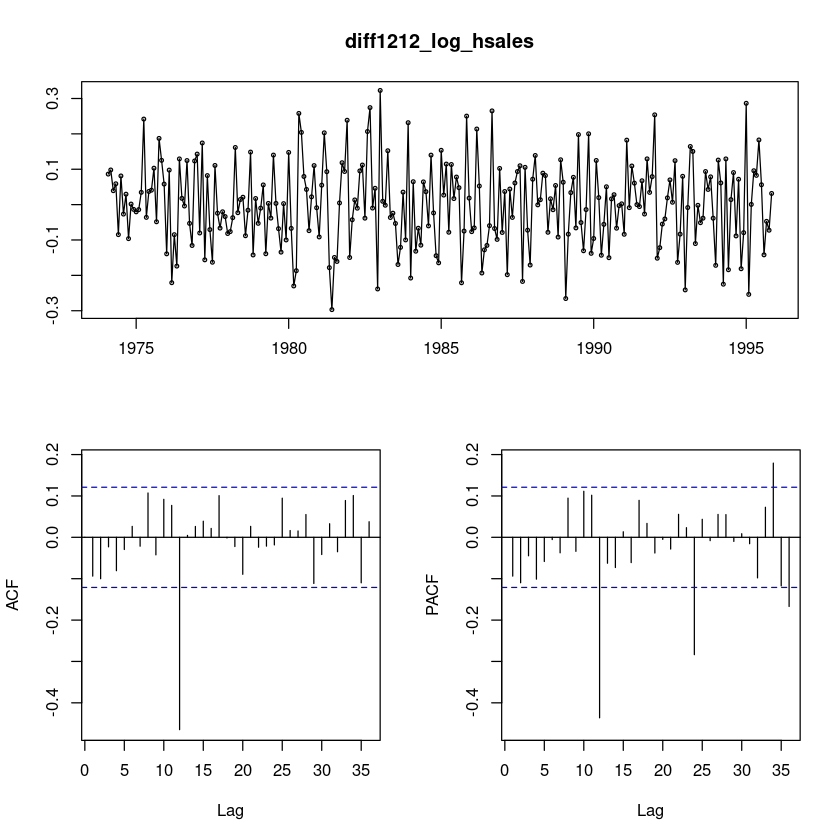

diff1212_log_hsales = diff(diff(log_hsales),12)

forecast::tsdisplay(diff1212_log_hsales)

diff1212_log_hsales: \(ARIMA(0,0,0)(0,0,1)_{12}\)이므로

log_hsales: \(ARIMA(0,1,0)(0,1,1)_{12}\)

12

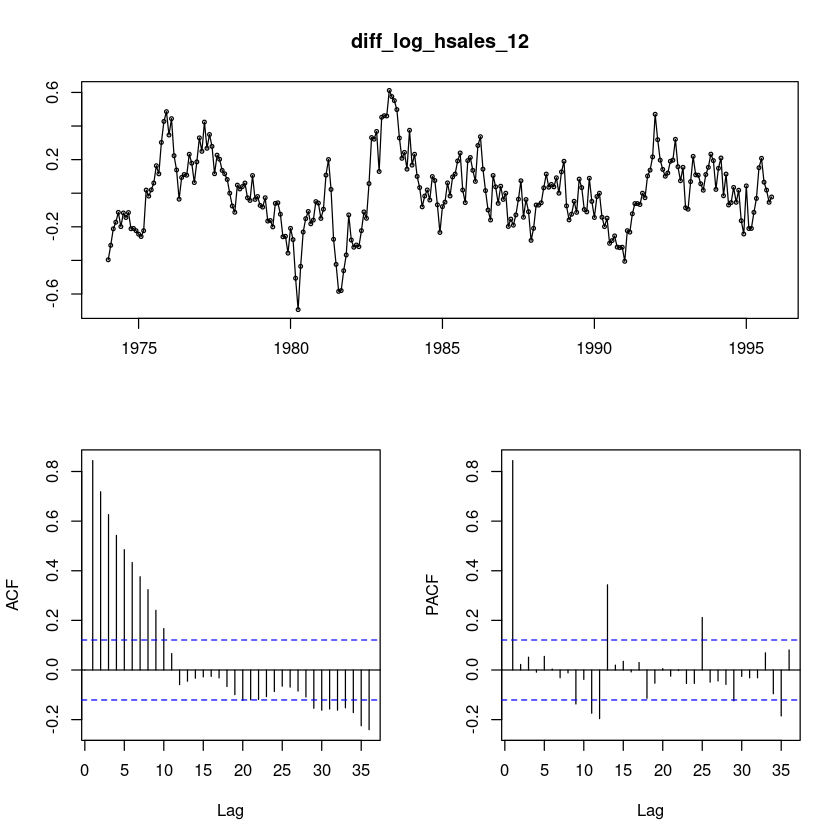

diff_log_hsales_12 = diff(log_hsales,12)

forecast::tsdisplay(diff_log_hsales_12)

ACF는 천천히 감소하는 형태이다. 계절차분을 했는데도 확률적 차분이 있어보인다. 한 번 더 차분을 해볼까?

평균은 0근처이다.

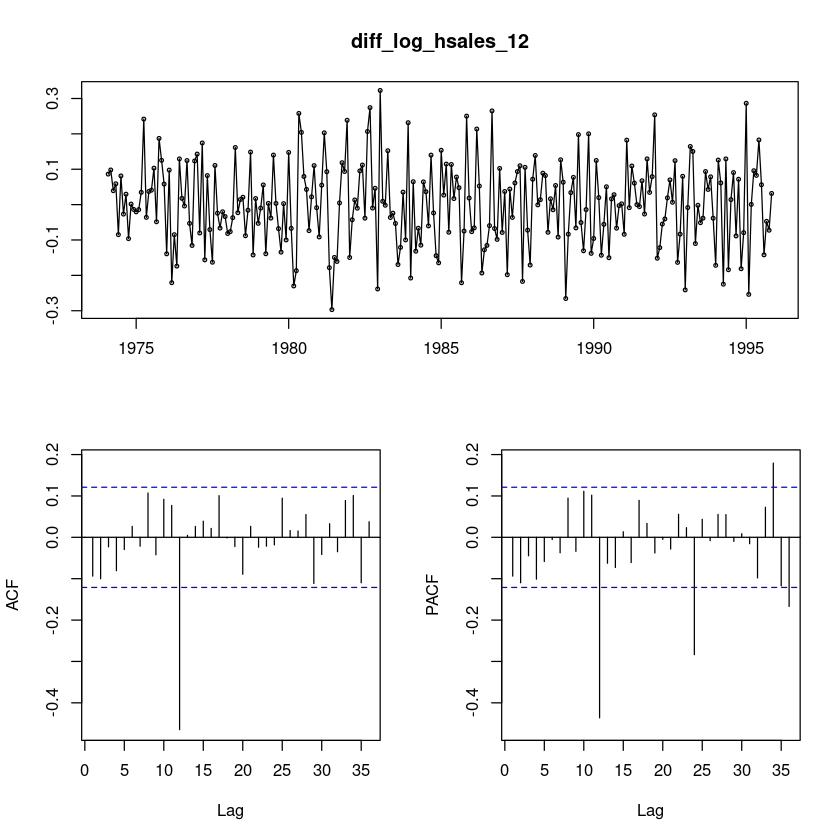

diff_log_hsales_12 = diff(diff(log_hsales,12))

forecast::tsdisplay(diff_log_hsales_12)

- 차분먼저 하고 -> 계쩔차분 한거랑.. 반대로 한거랑 비슷하게 나온당.

t.test(diff_log_hsales_12)

One Sample t-test

data: diff_log_hsales_12

t = 0.19616, df = 261, p-value = 0.8446

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.01289978 0.01575430

sample estimates:

mean of x

0.001427261 차분을 했더니 평균이 0이 되었다. t.test를 통해 0인것 확인

단위근 검정을 통해 차분이 더 필요한지 확인해 보기

##단위근 검정 : H0 : 단위근이 있다.

fUnitRoots::adfTest(diff_log_hsales_12, lags = 1, type = "nc")

fUnitRoots::adfTest(diff_log_hsales_12, lags = 2, type = "nc")

fUnitRoots::adfTest(diff_log_hsales_12, lags = 3, type = "nc")

Warning message in fUnitRoots::adfTest(diff_log_hsales_12, lags = 1, type = "nc"):

“p-value smaller than printed p-value”

Warning message in fUnitRoots::adfTest(diff_log_hsales_12, lags = 2, type = "nc"):

“p-value smaller than printed p-value”

Warning message in fUnitRoots::adfTest(diff_log_hsales_12, lags = 3, type = "nc"):

“p-value smaller than printed p-value”

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -13.3169

P VALUE:

0.01

Description:

Tue Dec 12 21:26:53 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 2

STATISTIC:

Dickey-Fuller: -10.7125

P VALUE:

0.01

Description:

Tue Dec 12 21:26:53 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 3

STATISTIC:

Dickey-Fuller: -9.8584

P VALUE:

0.01

Description:

Tue Dec 12 21:26:53 2023 by user: 유의확률이 작아서 차분을 할 필요가 없다!

정상시계열로 잘 변환된 것 같다.

(4)

모형을 식별하여라. (2개 이상의 모형 고려)(형태 : \(ARIMA(p.d.q)(P, D, Q)_s)\)

diff1212_log_hsales: \(ARIMA(0,0,0)(0,0,1)_{12}\)이므로

log_hsales: \(ARIMA(0,1,0)(0,1,1)_{12}\)

ARIMA(0,0,1)(1,0,0)_{12}도 생각

(5)

(4)에서 고려한 모형을 적합하여라.

fit6 = arima(log_hsales, order = c(0,1,0), include.mean=F,

seasonal = list(order = c(0,1,1), period=12))

summary(fit6)

lmtest::coeftest(fit6)

Call:

arima(x = log_hsales, order = c(0, 1, 0), seasonal = list(order = c(0, 1, 1),

period = 12), include.mean = F)

Coefficients:

sma1

-0.9999

s.e. 0.0801

sigma^2 estimated as 0.007124: log likelihood = 257.18, aic = -510.35

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.003952528 0.08239128 0.06409028 0.08562818 1.645261 0.64136

ACF1

Training set -0.1038561

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

sma1 -0.999931 0.080144 -12.477 < 2.2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1fit3 = arima(log_hsales, order = c(0,1,1), include.mean=F,

seasonal = list(order = c(0,1,1), period=12))

summary(fit3)

lmtest::coeftest(fit3)

Call:

arima(x = log_hsales, order = c(0, 1, 1), seasonal = list(order = c(0, 1, 1),

period = 12), include.mean = F)

Coefficients:

ma1 sma1

-0.1111 -1.0000

s.e. 0.0656 0.0765

sigma^2 estimated as 0.007046: log likelihood = 258.6, aic = -511.21

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.004407847 0.08194001 0.06413126 0.09625902 1.647035 0.6417701

ACF1

Training set -0.0006868962

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ma1 -0.111134 0.065604 -1.694 0.09026 .

sma1 -0.999971 0.076478 -13.075 < 2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1fit4 <- forecast::auto.arima(ts(log_hsales, frequency=12),

test = "adf",

seasonal = TRUE, trace = F)

summary(fit4)

lmtest::coeftest(fit4)Series: ts(log_hsales, frequency = 12)

ARIMA(2,0,2)(2,1,0)[12] with drift

Coefficients:

ar1 ar2 ma1 ma2 sar1 sar2 drift

0.0498 0.8203 0.8434 -0.0280 -0.6244 -0.3207 -0.0005

s.e. 0.3203 0.2978 0.3281 0.0737 0.0617 0.0615 0.0035

sigma^2 = 0.009325: log likelihood = 241.64

AIC=-467.28 AICc=-466.71 BIC=-438.7

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.001548434 0.09317171 0.07411262 0.005293838 1.907259 0.4415353

ACF1

Training set -0.008857548

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 0.0497676 0.3203457 0.1554 0.876541

ar2 0.8202974 0.2978056 2.7545 0.005879 **

ma1 0.8433986 0.3281198 2.5704 0.010158 *

ma2 -0.0280483 0.0737334 -0.3804 0.703647

sar1 -0.6243889 0.0617155 -10.1172 < 2.2e-16 ***

sar2 -0.3206978 0.0614554 -5.2184 1.805e-07 ***

drift -0.0004683 0.0034659 -0.1351 0.892520

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1(6)

(5)에서 적합된 결과를 이용하여 더 좋은 모형을 선택하여라

- \(ARIMA(0,1,1)(0,1,1)_{12}\)

(7)

(6)에서 선택한 모형을 이용하여 잔차검정을 시행하여라

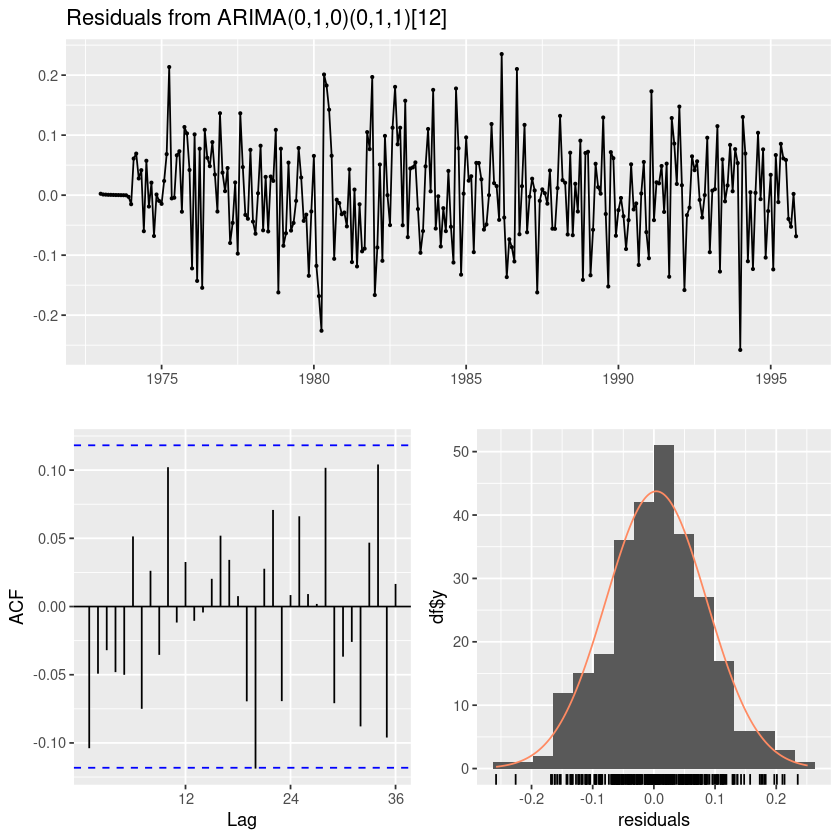

forecast::checkresiduals(fit6)

Ljung-Box test

data: Residuals from ARIMA(0,1,0)(0,1,1)[12]

Q* = 21.749, df = 23, p-value = 0.5355

Model df: 1. Total lags used: 24

t.test(resid(fit6))

One Sample t-test

data: resid(fit6)

t = 0.795, df = 274, p-value = 0.4273

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.005835073 0.013740130

sample estimates:

mean of x

0.003952528 잔차 평균 0

#모형 적합도 검정 : H0 : rho1=...=rho_k=0

Box.test(resid(fit6), lag=1, type = "Ljung-Box")

Box.test(resid(fit6), lag=6, type = "Ljung-Box")

Box.test(resid(fit6), lag=12, type = "Ljung-Box")

Box-Ljung test

data: resid(fit6)

X-squared = 2.9987, df = 1, p-value = 0.08333

Box-Ljung test

data: resid(fit6)

X-squared = 6.0675, df = 6, p-value = 0.4157

Box-Ljung test

data: resid(fit6)

X-squared = 11.569, df = 12, p-value = 0.4809fit6

Call:

arima(x = log_hsales, order = c(0, 1, 0), seasonal = list(order = c(0, 1, 1),

period = 12), include.mean = F)

Coefficients:

sma1

-0.9999

s.e. 0.0801

sigma^2 estimated as 0.007124: log likelihood = 257.18, aic = -510.35aic가 큰 차이가 없어서.. 그냥 모형 간단한 fit6

lmtest::coeftest(fit6)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

sma1 -0.999931 0.080144 -12.477 < 2.2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1(8)

다음 2년간의 주택의 월별 거래량을 예측하여라.

fore_fit <- forecast::forecast(fit6, 24)fore_fit Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

Dec 1995 3.692314 3.581718 3.802911 3.523171 3.861457

Jan 1996 3.820471 3.664063 3.976878 3.581266 4.059675

Feb 1996 3.941495 3.749996 4.132993 3.648622 4.234367

Mar 1996 4.120349 3.899260 4.341438 3.782223 4.458475

Apr 1996 4.097816 3.850655 4.344978 3.719815 4.475817

May 1996 4.096899 3.826164 4.367634 3.682846 4.510952

Jun 1996 4.052821 3.760407 4.345234 3.605612 4.500029

Jul 1996 3.995515 3.682922 4.308108 3.517445 4.473584

Aug 1996 4.018546 3.687000 4.350092 3.511490 4.525602

Sep 1996 3.934200 3.584727 4.283673 3.399727 4.468673

Oct 1996 3.913847 3.547323 4.280371 3.353297 4.474397

Nov 1996 3.776082 3.393265 4.158898 3.190614 4.361549

Dec 1996 3.684206 3.284402 4.084011 3.072758 4.295654

Jan 1997 3.812363 3.396263 4.228462 3.175993 4.448732

Feb 1997 3.933387 3.501687 4.365086 3.273159 4.593614

Mar 1997 4.112241 3.665485 4.558996 3.428987 4.795495

Apr 1997 4.089708 3.628388 4.551029 3.384180 4.795237

May 1997 4.088791 3.613352 4.564230 3.361670 4.815913

Jun 1997 4.044712 3.555562 4.533863 3.296621 4.792804

Jul 1997 3.987407 3.484919 4.489895 3.218917 4.755896

Aug 1997 4.010438 3.494958 4.525919 3.222079 4.798798

Sep 1997 3.926092 3.397939 4.454245 3.118351 4.733833

Oct 1997 3.905739 3.365209 4.446268 3.079071 4.732407

Nov 1997 3.767974 3.215346 4.320602 2.922802 4.613145exp(fore_fit$mean)| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1995 | 40.13763 | |||||||||||

| 1996 | 45.62569 | 51.49551 | 61.58072 | 60.20867 | 60.15348 | 57.55958 | 54.35380 | 55.62019 | 51.12123 | 50.09127 | 43.64469 | 39.81351 |

| 1997 | 45.25725 | 51.07967 | 61.08344 | 59.72247 | 59.66772 | 57.09477 | 53.91488 | 55.17104 | 50.70842 | 49.68677 | 43.29224 |

- 그림은 그냥 log변환했던 그림으로..

plot(fore_fit)

6

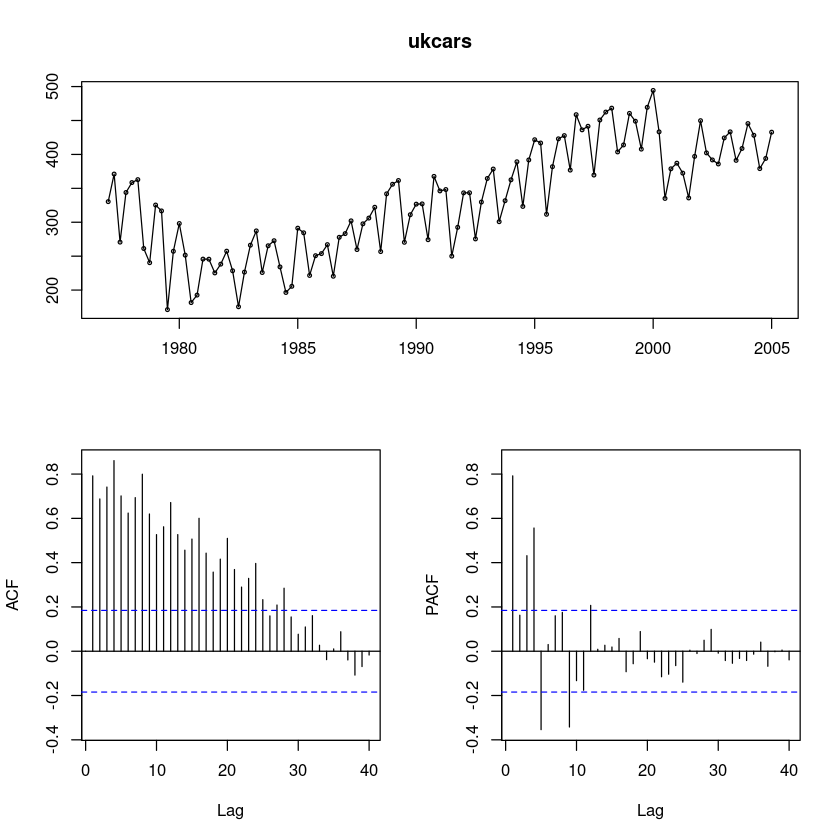

(R실습) 영국의 분기별 승용차 생산 대수 (단위 : 천 대) 자료(expsmooth::ukcars)에 대하여 다음 물음에 답하여라.

install.packages("expsmooth")

library(expsmooth)Installing package into ‘/home/coco/R/x86_64-pc-linux-gnu-library/4.2’

(as ‘lib’ is unspecified)

(1)

시계열 그림을 그리시오.

forecast::tsdisplay(ukcars,lag.max=40)

- acf가 중간중에 튀어나오는게 보인다. 계절차분.. 주기가 4인것 같다.

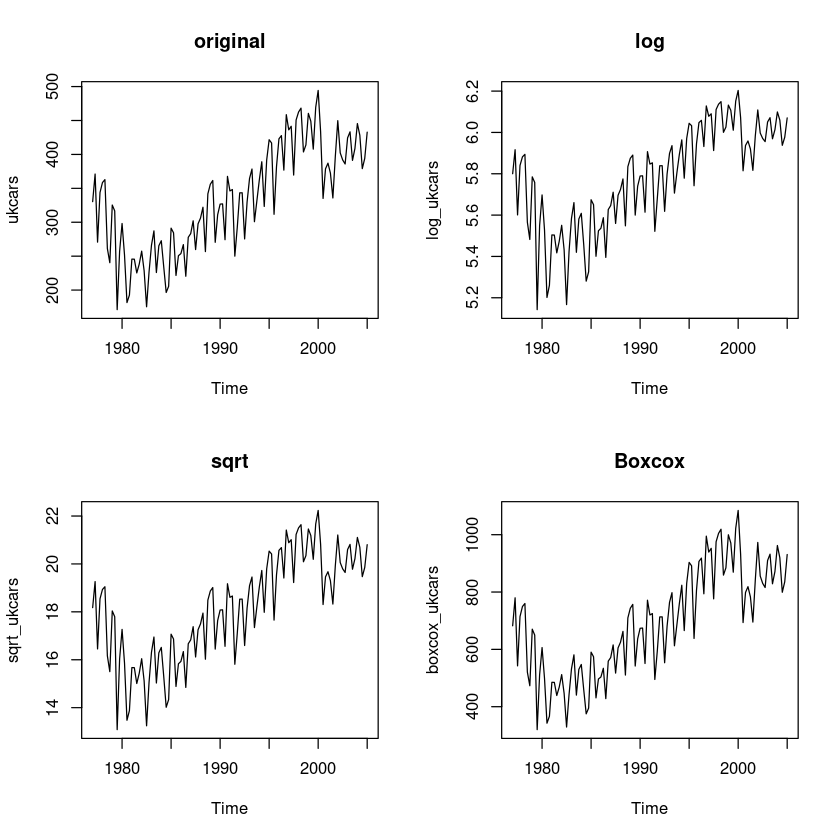

(2)

변수변환이 필요한지를 설명하고, 필요하다면 적절한 변수 변환을 하여라.

log_ukcars = log(ukcars)

sqrt_ukcars = sqrt(ukcars)

boxcox_ukcars = forecast::BoxCox(ukcars,lambda= forecast::BoxCox.lambda(ukcars))par(mfrow=c(2,2))

plot.ts(ukcars, main = "original")

plot.ts(log_ukcars, main = 'log')

plot.ts(sqrt_ukcars, main = 'sqrt')

plot.ts(boxcox_ukcars, main = 'Boxcox')

t = 1:length(ukcars)

lmtest::bptest(lm(ukcars~t)) #H0 : 등분산이다

lmtest::bptest(lm(log_ukcars~t))

lmtest::bptest(lm(sqrt_ukcars~t))

lmtest::bptest(lm(boxcox_ukcars~t))

studentized Breusch-Pagan test

data: lm(ukcars ~ t)

BP = 9.389, df = 1, p-value = 0.002183

studentized Breusch-Pagan test

data: lm(log_ukcars ~ t)

BP = 20.839, df = 1, p-value = 4.997e-06

studentized Breusch-Pagan test

data: lm(sqrt_ukcars ~ t)

BP = 15.696, df = 1, p-value = 7.439e-05

studentized Breusch-Pagan test

data: lm(boxcox_ukcars ~ t)

BP = 7.5728, df = 1, p-value = 0.005926ARIMA(1,0,1)(2,0,0)_4 아닐지도..

##단위근 검정 : H0 : 단위근이 있다.

fUnitRoots::adfTest(diff4_log_ukcars, lags = 0, type = "nc")

fUnitRoots::adfTest(diff4_log_ukcars, lags = 1, type = "nc")

fUnitRoots::adfTest(diff4_log_ukcars, lags = 2, type = "nc")Warning message in fUnitRoots::adfTest(diff4_log_ukcars, lags = 0, type = "nc"):

“p-value smaller than printed p-value”

Warning message in fUnitRoots::adfTest(diff4_log_ukcars, lags = 1, type = "nc"):

“p-value smaller than printed p-value”

Warning message in fUnitRoots::adfTest(diff4_log_ukcars, lags = 2, type = "nc"):

“p-value smaller than printed p-value”

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 0

STATISTIC:

Dickey-Fuller: -6.2158

P VALUE:

0.01

Description:

Wed Dec 13 14:05:45 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -5.6776

P VALUE:

0.01

Description:

Wed Dec 13 14:05:45 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 2

STATISTIC:

Dickey-Fuller: -5.9791

P VALUE:

0.01

Description:

Wed Dec 13 14:05:45 2023 by user: - pvalue값이 0.05보다 작으므로 차분이 필요하지 않다

t.test(diff4_log_ukcars)

One Sample t-test

data: diff4_log_ukcars

t = 0.65613, df = 108, p-value = 0.5131

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.01643180 0.03269295

sample estimates:

mean of x

0.008130578 - 평균이 0이다.

(3)

마지막 2년동안의 데이터는 test데이터, 나머지는 train 데이터로 분할하여라

uk_tr <- head(log_ukcars,-8)

uk_ts <- tail(log_ukcars,8)uk_tr # train| Qtr1 | Qtr2 | Qtr3 | Qtr4 | |

|---|---|---|---|---|

| 1977 | 5.800216 | 5.916340 | 5.600900 | 5.840293 |

| 1978 | 5.881904 | 5.893912 | 5.565596 | 5.482117 |

| 1979 | 5.785000 | 5.757955 | 5.142558 | 5.549920 |

| 1980 | 5.697520 | 5.527300 | 5.201559 | 5.260605 |

| 1981 | 5.503916 | 5.503403 | 5.417260 | 5.473157 |

| 1982 | 5.550573 | 5.431366 | 5.166904 | 5.422577 |

| 1983 | 5.584060 | 5.660356 | 5.420017 | 5.580910 |

| 1984 | 5.608589 | 5.455894 | 5.280469 | 5.325694 |

| 1985 | 5.674295 | 5.650459 | 5.400743 | 5.524245 |

| 1986 | 5.536377 | 5.587309 | 5.395390 | 5.626905 |

| 1987 | 5.646270 | 5.710665 | 5.559604 | 5.695945 |

| 1988 | 5.724007 | 5.774881 | 5.547998 | 5.834451 |

| 1989 | 5.874942 | 5.890373 | 5.600024 | 5.740130 |

| 1990 | 5.789006 | 5.790141 | 5.614066 | 5.907012 |

| 1991 | 5.846910 | 5.852809 | 5.521493 | 5.678526 |

| 1992 | 5.838657 | 5.838980 | 5.618174 | 5.798326 |

| 1993 | 5.898584 | 5.936079 | 5.706439 | 5.804403 |

| 1994 | 5.893124 | 5.963921 | 5.778649 | 5.970833 |

| 1995 | 6.044166 | 6.032662 | 5.742083 | 5.945164 |

| 1996 | 6.047330 | 6.058473 | 5.931847 | 6.128135 |

| 1997 | 6.078158 | 6.090149 | 5.912329 | 6.110853 |

| 1998 | 6.136521 | 6.148964 | 6.000513 | 6.025740 |

| 1999 | 6.132304 | 6.106871 | 6.010745 | 6.151472 |

| 2000 | 6.203165 | 6.071292 | 5.814447 | 5.936995 |

| 2001 | 5.958683 | 5.919955 | 5.816486 | 5.984138 |

| 2002 | 6.108703 | 5.997079 | 5.970871 | 5.955552 |

| 2003 | 6.050500 |

uk_ts # test| Qtr1 | Qtr2 | Qtr3 | Qtr4 | |

|---|---|---|---|---|

| 2003 | 6.071384 | 5.969252 | 6.013079 | |

| 2004 | 6.099103 | 6.059595 | 5.937663 | 5.976458 |

| 2005 | 6.070266 |

(4)

train 데이터에 이동평균 모형을 적합하고, 마지막 2년의 승용차 생산 대수를 예측하여라.

fitt <- SMA(uk_tr,10)forecast(tail(fitt,-9),8) Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

2003 Q2 5.976598 5.958328 5.994868 5.948657 6.004539

2003 Q3 5.966925 5.930276 6.003575 5.910874 6.022977

2003 Q4 5.965189 5.905953 6.024426 5.874595 6.055784

2004 Q1 5.987854 5.903003 6.072705 5.858086 6.117622

2004 Q2 5.993410 5.879633 6.107187 5.819403 6.167416

2004 Q3 5.982569 5.840527 6.124611 5.765334 6.199803

2004 Q4 5.979765 5.808140 6.151391 5.717287 6.242244

2005 Q1 6.001492 5.798600 6.204384 5.691195 6.311789fitt_<-forecast(tail(fitt,-9),8)

fit1_mean<-exp(fitt_$mean)

fit1_mean| Qtr1 | Qtr2 | Qtr3 | Qtr4 | |

|---|---|---|---|---|

| 2003 | 394.0974 | 390.3038 | 389.6268 | |

| 2004 | 398.5584 | 400.7789 | 396.4574 | 395.3476 |

| 2005 | 404.0312 |

plot(forecast(tail(fitt,-9),8))

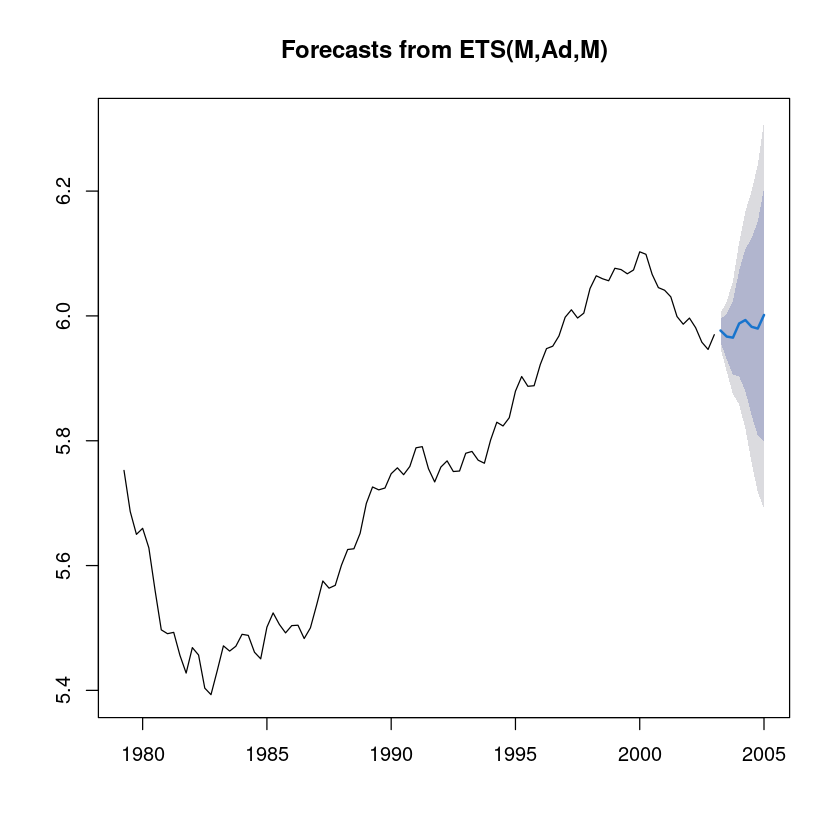

(5)

train 데이터에 지수평활 모형을 적합하고, 마지막 2년의 승용차 생산 대수예측하여라

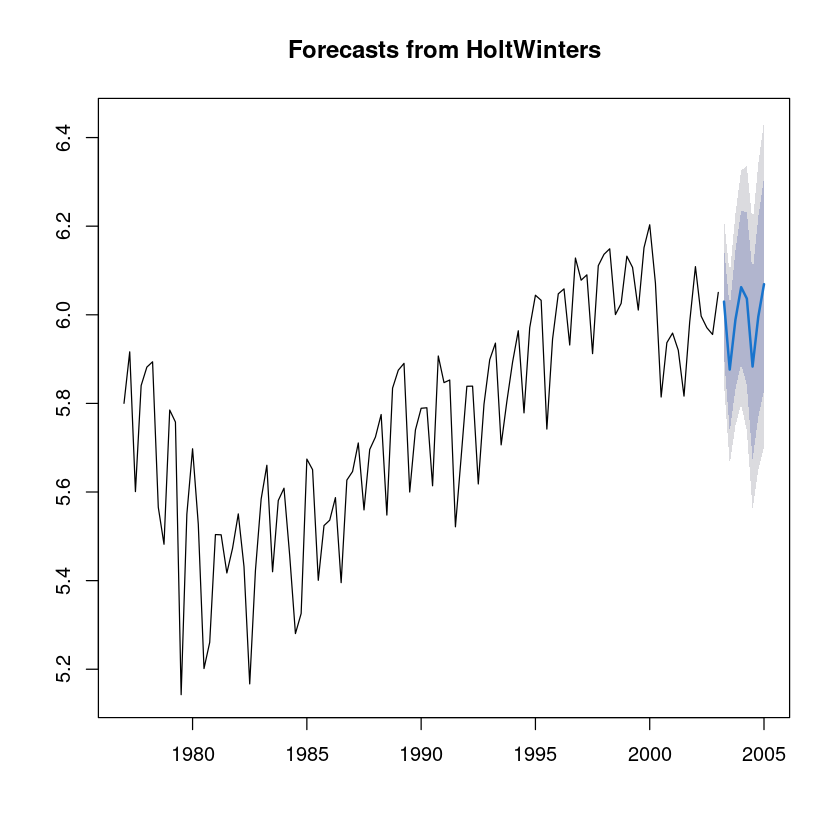

fit2=HoltWinters(uk_tr)

fit2Holt-Winters exponential smoothing with trend and additive seasonal component.

Call:

HoltWinters(x = uk_tr)

Smoothing parameters:

alpha: 0.5359051

beta : 0.03931353

gamma: 0.280097

Coefficients:

[,1]

a 5.958690456

b 0.001696387

s1 0.069343432

s2 -0.085652720

s3 0.025071836

s4 0.096844294fit2_2=forecast(fit2, h=8)

plot(fit2_2)

fit2_2 Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

2003 Q2 6.029730 5.907757 6.151703 5.843189 6.216272

2003 Q3 5.876431 5.736814 6.016047 5.662906 6.089955

2003 Q4 5.988851 5.832443 6.145260 5.749645 6.228058

2004 Q1 6.062320 5.889683 6.234958 5.798294 6.326346

2004 Q2 6.036516 5.841129 6.231902 5.737698 6.335334

2004 Q3 5.883216 5.672756 6.093676 5.561345 6.205087

2004 Q4 5.995637 5.770205 6.221069 5.650868 6.340406

2005 Q1 6.069106 5.828757 6.309455 5.701524 6.436688fit2_mean <- exp(fit2_2$mean)

fit2_mean| Qtr1 | Qtr2 | Qtr3 | Qtr4 | |

|---|---|---|---|---|

| 2003 | 415.6029 | 356.5343 | 398.9561 | |

| 2004 | 429.3706 | 418.4326 | 358.9618 | 401.6725 |

| 2005 | 432.2940 |

(6)

train 데이터에 계절형 ARIMA 모형을 적합하고, 마지막 2년의 승용차 생산 대수 예측하여라.

fit3 <- forecast::auto.arima(ts(uk_tr, frequency=4),

test = "adf",

seasonal = TRUE, trace = T)

fit3

ARIMA(2,0,2)(1,1,1)[4] with drift : Inf

ARIMA(0,0,0)(0,1,0)[4] with drift : -116.3653

ARIMA(1,0,0)(1,1,0)[4] with drift : -172.5345

ARIMA(0,0,1)(0,1,1)[4] with drift : -157.3235

ARIMA(0,0,0)(0,1,0)[4] : -118.0766

ARIMA(1,0,0)(0,1,0)[4] with drift : -139.6757

ARIMA(1,0,0)(2,1,0)[4] with drift : -176.0384

ARIMA(1,0,0)(2,1,1)[4] with drift : -177.9085

ARIMA(1,0,0)(1,1,1)[4] with drift : -180.1665

ARIMA(1,0,0)(0,1,1)[4] with drift : -179.5978

ARIMA(1,0,0)(1,1,2)[4] with drift : -178.205

ARIMA(1,0,0)(0,1,2)[4] with drift : -180.1353

ARIMA(1,0,0)(2,1,2)[4] with drift : -176.0221

ARIMA(0,0,0)(1,1,1)[4] with drift : -132.7479

ARIMA(2,0,0)(1,1,1)[4] with drift : -181.6961

ARIMA(2,0,0)(0,1,1)[4] with drift : -180.0464

ARIMA(2,0,0)(1,1,0)[4] with drift : -172.5136

ARIMA(2,0,0)(2,1,1)[4] with drift : -179.6537

ARIMA(2,0,0)(1,1,2)[4] with drift : -180.4408

ARIMA(2,0,0)(0,1,0)[4] with drift : -138.1924

ARIMA(2,0,0)(0,1,2)[4] with drift : -181.1778

ARIMA(2,0,0)(2,1,0)[4] with drift : -175.4253

ARIMA(2,0,0)(2,1,2)[4] with drift : -178.0885

ARIMA(3,0,0)(1,1,1)[4] with drift : -180.5785

ARIMA(2,0,1)(1,1,1)[4] with drift : -181.1476

ARIMA(1,0,1)(1,1,1)[4] with drift : -183.0138

ARIMA(1,0,1)(0,1,1)[4] with drift : -180.5136

ARIMA(1,0,1)(1,1,0)[4] with drift : -173.0476

ARIMA(1,0,1)(2,1,1)[4] with drift : -181.3413

ARIMA(1,0,1)(1,1,2)[4] with drift : -182.1301

ARIMA(1,0,1)(0,1,0)[4] with drift : -137.9048

ARIMA(1,0,1)(0,1,2)[4] with drift : -182.1227

ARIMA(1,0,1)(2,1,0)[4] with drift : -175.9096

ARIMA(1,0,1)(2,1,2)[4] with drift : -179.7711

ARIMA(0,0,1)(1,1,1)[4] with drift : -157.0855

ARIMA(1,0,2)(1,1,1)[4] with drift : -181.1722

ARIMA(0,0,2)(1,1,1)[4] with drift : -161.9388

ARIMA(1,0,1)(1,1,1)[4] : -185.1282

ARIMA(1,0,1)(0,1,1)[4] : -181.64

ARIMA(1,0,1)(1,1,0)[4] : -175.0856

ARIMA(1,0,1)(2,1,1)[4] : -183.3356

ARIMA(1,0,1)(1,1,2)[4] : -184.1763

ARIMA(1,0,1)(0,1,0)[4] : -139.9217

ARIMA(1,0,1)(0,1,2)[4] : -184.2699

ARIMA(1,0,1)(2,1,0)[4] : -178.0297

ARIMA(1,0,1)(2,1,2)[4] : -181.8691

ARIMA(0,0,1)(1,1,1)[4] : -158.4394

ARIMA(1,0,0)(1,1,1)[4] : -181.3926

ARIMA(2,0,1)(1,1,1)[4] : -183.3919

ARIMA(1,0,2)(1,1,1)[4] : -183.4158

ARIMA(0,0,0)(1,1,1)[4] : -134.1378

ARIMA(0,0,2)(1,1,1)[4] : -163.1242

ARIMA(2,0,0)(1,1,1)[4] : -183.4676

ARIMA(2,0,2)(1,1,1)[4] : -181.1076

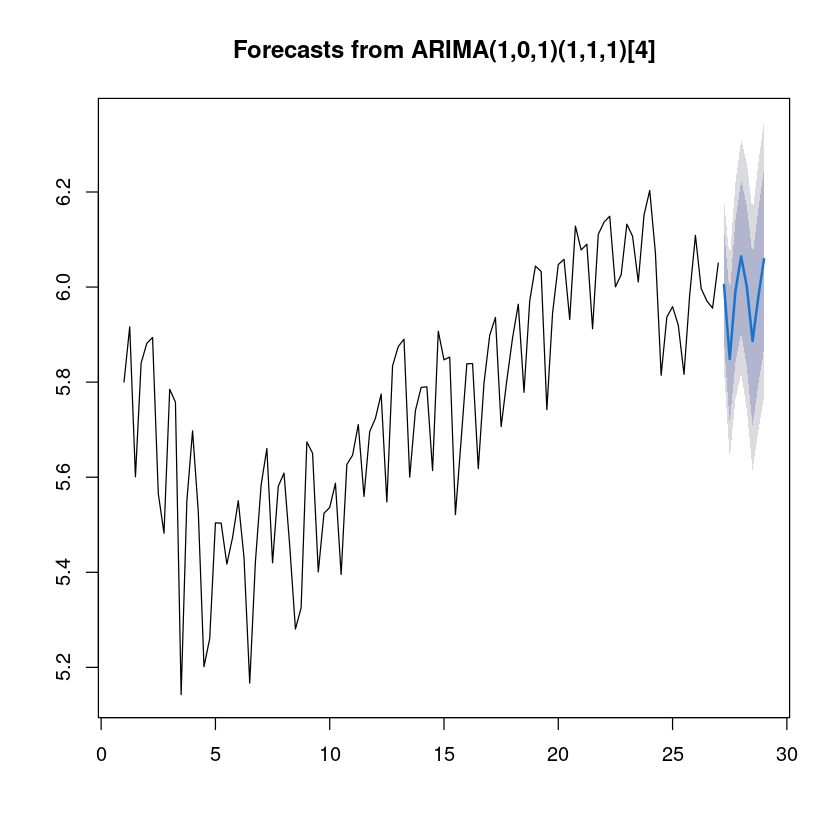

Best model: ARIMA(1,0,1)(1,1,1)[4]

Series: ts(uk_tr, frequency = 4)

ARIMA(1,0,1)(1,1,1)[4]

Coefficients:

ar1 ma1 sar1 sma1

0.9323 -0.3616 -0.3205 -0.6647

s.e. 0.0521 0.1286 0.1273 0.1251

sigma^2 = 0.008448: log likelihood = 97.88

AIC=-185.76 AICc=-185.13 BIC=-172.68fore_fit <- forecast::forecast(fit3, 8)

plot(fore_fit)

fit3_mean <- exp(fore_fit$mean)

fit3_mean| Qtr1 | Qtr2 | Qtr3 | Qtr4 | |

|---|---|---|---|---|

| 27 | 405.2362 | 346.7585 | 399.9905 | |

| 28 | 430.3242 | 403.6273 | 360.0729 | 394.8634 |

| 29 | 427.8340 |

(7)

(3)-(5) 모형의 결과에 대하여 MSE/MAPE/MAE를 구하고, 가장 좋은 모형을 선택하여라

test<-exp(uk_ts)mse1 <- mean((fit1_mean - test)^2)

mse2 <- mean((fit2_mean - test)^2)

mse3 <- mean((as.numeric(fit3_mean) - as.numeric(test))^2)

mse1

mse2

mse3mape1 <- mean(abs((fit1_mean - test)/test))*100

mape2 <- mean(abs((fit2_mean - test)/test))*100

mape3 <- mean(abs((as.numeric(fit3_mean) - as.numeric(test))/as.numeric(test)))*100

mape1

mape2

mape3mae1 <- mean(abs(test-fit1_mean))

mae2 <- mean(abs(test-fit2_mean))

mae3 <- mean(abs(as.numeric(test)-as.numeric(fit3_mean)))

mae1

mae2

mae3